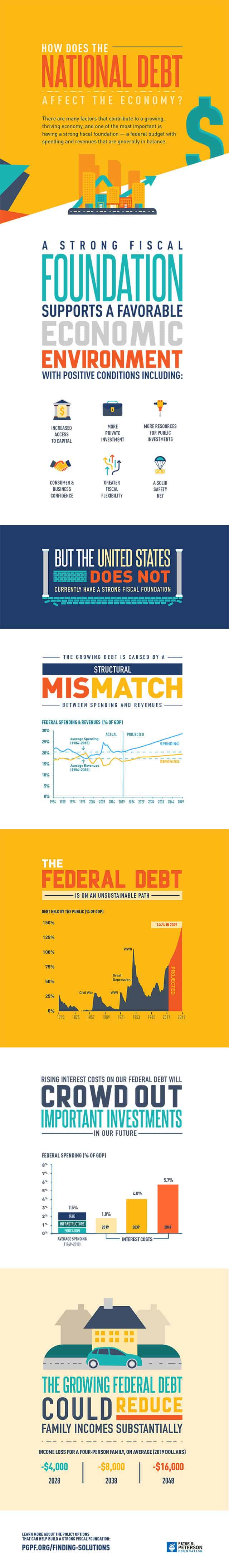

Policymakers and pundits often depict fiscal responsibility and economic growth as being at odds with one another. In truth, however, a strong fiscal outlook is an essential foundation for a growing, thriving economy. With a strong fiscal foundation, the nation will have increased access to capital, more resources for public and private investments in our future, improved consumer and business confidence, and a stronger safety net.

Unfortunately, the opposite is also true — and the United States does not currently have a strong fiscal foundation. The amount of debt relative to the size of the economy is about the highest it has been since just after World War II and is projected to climb significantly in coming years.

The good news is that improving our fiscal outlook can result in positive economic gains. For example, a study by Macroeconomic Advisers found that lawmakers can stabilize the fiscal outlook while providing long-run economic benefits for American families.

Learn more about the relationship between the national debt and our economy in the infographic below, and read about some of the

Further Reading

What’s the Difference Between the Trade Deficit and Budget Deficit?

The terms “budget deficit” and “trade deficit” can be conflated, but they are distinct measurements of important fiscal and economic concepts.

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.

What Types of Securities Does the Treasury Issue?

Learn about the different types of Treasury securities issued to the public as well as trends in interest rates and maturity terms.