The Deficit Was Cut in Half in 2022 Thanks to the Expiration of Pandemic-Related Spending

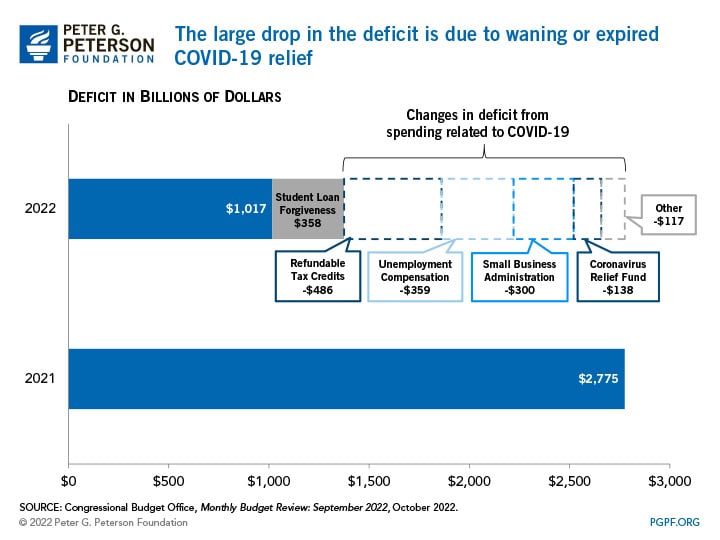

In fiscal year 2022, which ended on September 30, 2022, the federal government incurred a budget deficit of $1.4 trillion — about half the size of last year’s deficit. That sizable reduction was primarily due to the expiration of programs enacted in response to the COVID-19 pandemic.

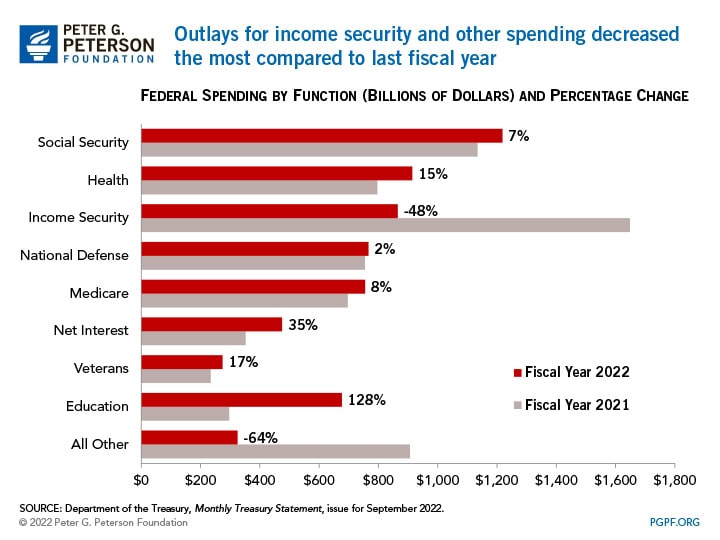

Federal spending was $6.3 trillion in fiscal year 2022, which was $550 billion less than last year’s total (a decrease of 8 percent). Spending for a number of programs — mostly related to the pandemic response — dropped significantly relative to 2021. For example, outlays for stimulus payments and other refundable tax credits decreased by $486 billion because such payments were not issued in 2022. As the economy recovered and additional support for unemployment expired, spending on unemployment insurance was significantly reduced; such spending was $359 billion less in fiscal year 2022 than fiscal year 2021. Furthermore, spending by the Small Business Administration decreased by $300 billion, mostly due to the expiration of the Paycheck Protection Program in May 2021. Finally, there was a $138 billion reduction in coronavirus relief allocated to state and local governments.

Partially offsetting the decreases in outlays was the effect of the Administration’s plan to forgive certain portions of federal student loans; the cost of that policy (which is recorded in the budget on a present-value basis) increased outlays for the Department of Education by $358 billion in 2022. In addition, higher inflation and interest rates lifted interest payments on the public debt by $121 billion.

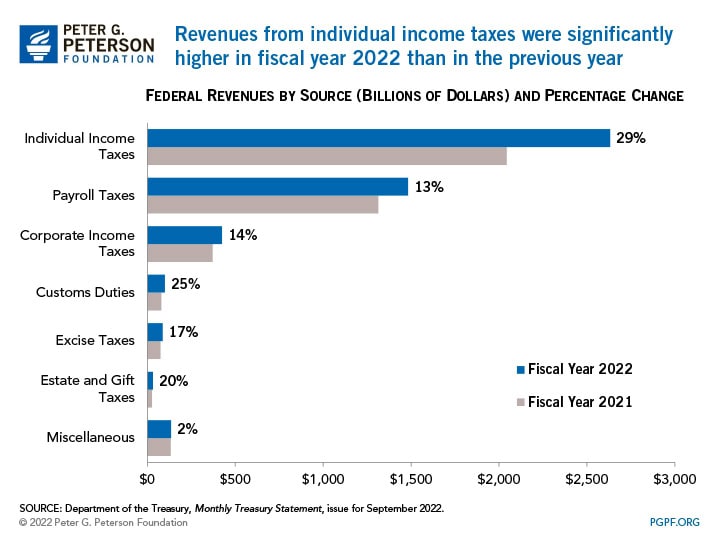

The government also brought in $850 billion more in revenues (a 21 percent increase) last year compared to fiscal year 2021. That change primarily came from an increase in collections of individual income and payroll taxes, reflecting growth in the economy. Specifically, amounts withheld from workers’ paychecks rose by $382 billion, which was due to higher tax rates on increased wages and salaries. Receipts for payroll taxes also increased because the temporary provision that allowed employers to defer paying parts of the payroll taxes expired.

Although the deficit last year fell by half relative to the previous year, such progress was largely attributable to COVID relief expiring; the nation still has a ways to go in putting the budget on a sustainable path. Although most programs put in place in response to the pandemic have waned, the nation’s projected deficits remain high. Those deficits are likely to exceed $1 trillion annually, indefinitely, if current laws remain the same. As the United States enters the new fiscal year, policymakers should focus on making progress on the structural issues that existed long before the pandemic and threaten our nation’s economic strength and preparedness in the years to come.

Image credit: Samuel Corum/Getty Images

Further Reading

Top 10 Reasons Why the National Debt Matters

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.