The Debt Crisis Is Here

Dana M. Peterson and Lori Esposito Murray

This paper is part of an initiative from the Peterson Foundation to help illuminate and understand key fiscal and economic questions facing America. See more papers in the Expert Views: Fiscal Commission series.

The outsized U.S. national debt is now $33.6 trillion, and the excessive deficits have reached new highs at $1.7 trillion for the fiscal year — 5.8% of GDP. The cost of servicing this debt due to inflation and rising interest rates is also increasing by $162 billion, reaching $879 billion in FY 2023, approximately the size of the defense budget. The rise in the cost of servicing the debt is the significant challenge, often warned about in the past but now here to stay for at least some time, threatening to crowd out federal spending priorities.

The congressional debate this year over FY2024 spending levels has contributed to an historic collapse of governance in the U.S. Congress, a broken budget process, the brink of a national default, a looming government shutdown, and the potential downgrading of the U.S. credit rating. U.S. global leadership and national security are at risk.

The Debt Crisis is here — not down the road. As a nation, we must act now. An important step — establish a Bipartisan Congressional Committee on Fiscal Responsibility.

While commissions are not silver bullets, there are several main benefits that a bipartisan commission can bring to help address our national debt challenge.

- Business supports its establishment. The Committee for Economic Development, the public policy center of The Conference Board (CED), polled CED Trustee CEOs and Board Directors between September 25 and September 28, 2023. 87% of respondents believe a bipartisan congressional commission on fiscal responsibility could help reduce the national debt. Business leaders are major stakeholders in the U.S. economy, and their support is critical to the success of a commission.

- The budget process is broken and Congress knows it. Since FY 1977, Congress has passed all of its appropriations bills on time only four times. The last time the House and Senate passed all 12 spending bills that the president signed into law before funding expired was in 1997 — nearly 30 years ago. Since 2007, there have only been two times that the omnibus bill that bundles all appropriations in a single, giant bill has not been used. Support for a commission is growing in Congress, as a solution.

- The federal budget is a bipartisan issue. The national debt crisis must be solved by sustainable, bipartisan-supported solutions.

- Solutions need to be comprehensive, spanning mandatory and discretionary spending, and include a strategic objective. The FY2024 debate on FY2024 spending cuts is only addressing the funding provided in the 12 congressional appropriations bills, which cover approximately a quarter of the federal budget, the discretionary budget. And the budget objectives only target that small portion of the federal budget. Revenue is not being addressed. And most importantly, the largest portion of government expenditures, mandatory spending — about three-quarters of the federal budget — including programs such as Medicare and Social Security — is not currently on the table. As the nation approaches historic levels of debt to GDP, a strategic fiscal health goal needs to be set and policies developed to achieve that objective.

- Opportunity to raise public awareness/support. Public hearings and media outreach can raise public awareness, provide trusted information, and build support for the solutions, especially as they affect Social Security and Medicare. According to a Pew Research January 2023 survey, 57% of the public say that reducing the budget deficit should be a top priority, up from 45% in 2022, with both Republicans and Democrats more likely now to say this should be a top priority.

The Commission should be structured to include:

- Current members of Congress from both Houses with bipartisan representation committed to finding solutions. The dynamics in Washington have changed so profoundly; current members from both parties will understand the shared dynamics that they are operating under.

- Strict timelines. Given the stakes both at home and abroad, the commission should be established immediately and its comprehensive, strategic plan should be released within three months to provide the roadmap for the FY2025 budget and for the debt ceiling, which must once again be addressed by January 2, 2025.

Recommended Spending and Revenue Reforms

The Commission’s strategic objective:

- Reduce the U.S. debt-to-GDP ratio to 70%.

The three structural spending/revenue reforms to help achieve this objective address the biggest drivers of U.S. national debt: health care, social security, and tax revenue:

- Reform Medicare

- Save Social Security

- Implement Tax Reform

Strategic Objective — Reduce Debt-to-GDP Ratio to 70%: The debt-to-GDP ratio of 70% is a recognized stable level for advanced economies, which shows the burden of debt relative to the country’s total economic output and therefore its ability to repay it.

As the following analysis demonstrates, it would require a substantial realignment of fiscal policy and a multidecade plan to return debt to 70% of GDP, a more stable cap than the ratio today and those projected in the future, but still significantly above the much lower levels before the 2008 financial crisis, which were closer to 40%.

While it can be easy to expand debt rapidly, especially during a crisis, a plan for debt reduction will likely need to be more deliberate, sustained, and gradual to avoid sudden and large losses of income that can create recessions.

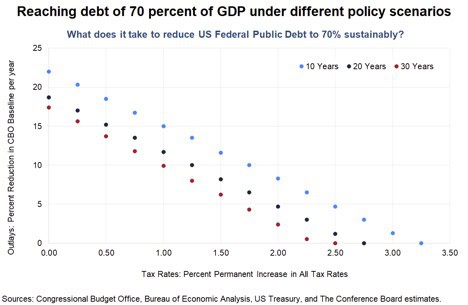

Figure 1 shows The Conference Board’s economic forecasting analysis of various scenarios of tax rate hikes and outlay cuts that can push debt-to-GDP to 70% (and lower) within 10, 20, and 30 years.

- Just raising taxes to cut the debt-to-GDP is not feasible, not only because it consumes private investment capacity, but also because the interest on the debt keeps rising. In this model, all tax rates would have to be raised by 3.25% to get to 70%. Still, it is not enough because the rising net interest starts outpacing the effect of the tax hike. Consequently, outlays also need to be cut.

- Just cutting outlays would work to achieve the objective, but it would have to be by about 22% year after year, which is draconian.

- Public debt-to-GDP can be lowered to 70% in 10 years, but it would induce a major recession in the near term.

The 20-year pathway is recommended, which is the most feasible, nearer-term time frame to restore a debt-to-GDP ratio of 70%, with the least draconian fiscal hardship. The below chart illustrates the timing and policy tradeoffs inherent to meeting this goal. A combination of raising all taxes by 1.5% permanently, and a reduction in outlays of 8.2% (including spending cuts and interest cost reductions as a result of lower debt) would achieve the goal of debt-to-GDP to 70% in about 20 years.

Three Structural Spending/Revenue Reforms

To tackle this strategy, the most important role of the commission is to address the biggest drivers of deficits and the long-term debt: Medicare and Social Security. Both of these programs’ costs are increasing due to the aging of the population. Medicare costs are rising as well due to higher medical costs. Also adding to the urgency is that both of these programs have pending deadlines for action with their Trust Funds becoming insolvent (Medicare in 2031 and Social Security in 2033).

The third challenge the Commission must address in tandem is revenue. Tax policy is also on the congressional policy docket for action. At the end of 2025, almost all of the individual, estate, and pass-through provisions of the Tax Cuts and Jobs Act (TCJA) will expire. This pending debate provides a policy opening for increasing revenues through tax reform.

In order to facilitate the very urgent timelines that the commission will be operating under, the roadmap provided by the Simpson Bowles Commission should serve as a foundational guidepost.

Save Social Security

Over 66 million seniors today receive Social Security payments, and with our aging population, that number is growing. The Social Security Trust Fund is projected to reach insolvency by 2033. Without adjustments, benefits will need to be slashed across the board by 25% or revenues increased by 33%. Otherwise, large transfers from general funds will be required — impacting more severely the deficit and changing the fundamental nature of the program from an earned benefit.

Several alternative approaches to save Social Security, which the commission should consider, include:

- Gradually raise the maximum earned income subject to the payroll tax to cover 90% of all wages, up from today’s 81%, and maintain that share in later years.

- Use a more accurate calculation of annual COLAs to index Social Security and other mandatory programs, by using the “chained CPI” measure, which the Bureau of Labor Statistics calculates along with the traditional CPI. CBO estimates this could reduce the deficit by $257.5 billion over ten years.

- Remove work disincentives for retirees to help bring more retirees back into the workforce.

- Raise the age gradually of Social Security benefits to 69. When the program was fully implemented in 1945, Americans became eligible for benefits at age 65 and the average life expectancy was 62. This and other changes to Social Security would save about $718 billion from Social Security over ten years.

- Cover newly hired state and local workers under Social Security, who can currently be exempt if states maintain a similar retirement program. According to CBO, this action would decrease the deficit by $131.5 billion over ten years.

- Diversify the Social Security Trust Funds investments from Treasury bills, similar to the reforms implemented in the Railroad Trust Funds. $1.5 trillion over five years would be placed in a diversified investment fund separate from the Social Security Trust Fund and held in escrow for 70 years. Under this plan, according to its main proponent, Senator Bill Cassidy, the 24% benefit cuts are eliminated and 75% of the Social Security shortfall is covered.

Reform Medicare

Reforming Medicare is a necessary condition for regaining fiscal health.

For the next 15 years, more people will convert to Medicare in America than people being born. Spending for health care programs is expected to exceed all other categories of federal spending by 2030. Aging of the population accounts for one-third of that growth; two-thirds is additional cost growth in the programs themselves, demonstrating the urgency of significant cost reforms.

By 2052, according to CBO, federal spending on health care programs will rise to 10.2% of GDP, compared to 6.6% in 2022. Spending on Medicare is projected to account for more than four-fifths of the increase in spending on major health care programs over the next 30 years as a percentage of GDP.

Medicare’s Hospital Insurance (HI) Trust fund is expected to end full payment of benefits in 2031. In the event of insolvency of the HI fund, mandatory spending cuts would occur beginning at 11%.

Approaches for a bipartisan commission to consider to Reform Medicare include:

- Put consumer choice into healthcare. Market forces could be unleashed if individual Medicare beneficiaries could choose on the basis of quality and price among private plans and the traditional Medicare system, competing on a level playing field. Today, Medicare underwrites a “fee-for-service” model for health care that has little incentive to reduce costs. A shift to a health care model that promotes cost-responsible consumer choice among competing private health care plans would drive the system toward quality, affordable health care for all, in a more connected system that encourages strong patient care outcomes holistically, through innovations such as team-based care.

- Eliminate Medicare Advantage (MA) price “benchmark.” The current MA program could be used as the foundation for a market-based reform of Medicare. Eliminating MA price “benchmark” based on traditional Medicare fee-for-service cost will help remove the influence of inflation-prone, inefficient fee-for-service medicine on Medicare costs. MA plans should be required to submit prices competitively, and the plans should be allowed to bid as low as their efficiency allows. According to CBO estimates, reducing the benchmarks paid to MA plans would save $392 billion over ten years.

- Raise the age of eligibility. In 2018, CBO estimated that raising the eligibility age for Medicare to 67 in two-month increments would, by 2028, have produced $42 billion of total savings from the period 2019–2028. (Younger Medicare beneficiaries generally use the system less than older beneficiaries.) A 2011 study from the Kaiser Family Foundation reached similar conclusions.

- Restrict states’ use of provider taxes. Some states are increasingly financing their share of Medicaid through means other than general revenues, such as taxes on providers. By increasing state revenues, this raises the federal matching share as well, leading to higher federal Medicaid costs. Restricting use of provider taxes to finance Medicaid has the potential to save $600 billion over ten years, according to CBO.

Reform Tax Policy

As our debt-to-GDP model demonstrates, Congress will need to implement revenue increases. At the end of 2025, Congress will be determining whether the provisions of the Tax Cuts and Jobs Act (TCJA) will be extended. This upcoming congressional debate creates an important opportunity for a third structural reform: Tax Reform. Given the high-charged and hyper-polarized debate on taxes, increasing revenue through tax reform may be a more politically viable alternative than a divisive, deadlocked debate on maintaining the cuts versus raising taxes.

- Principles of fairness, efficiency, and simplicity. Historical episodes of income tax reform consistent with principles of fairness, efficiency, and simplicity have been conducive to economic growth and budget improvement. Tax reform can yield higher revenue if based on the principles that taxes should generally be consistent in their treatment across all kinds of economic activity, paring back the use of preferential tax breaks and applying to as broad a base as possible. The Simpson Bowles Commission determined that, overall, the federal government gives up more in deductions (about $1.1 trillion) than it collects ($1 trillion).

- End some of the trillion dollar-plus tax expenditures; suggestions include: Tax capital gains and dividends as ordinary income. End the Alternative Minimum Tax and itemized deductions. Tax state and municipal bonds. Tax the following exclusions at higher income levels: health insurance benefits, retirement accounts, charitable giving, and mortgage interest. Increase the gas tax and index it to inflation, dedicating the revenue to the highway trust fund. Increase taxes on tobacco and alcohol. There are many other income tax loopholes, corporate tax subsidies, and deductions that could be eliminated.

Debt Matters

The nation has never, in years generally characterized by peace, experienced the debt explosion that we have had since 1981. The danger of this explosion has been sidestepped, obscured, or excused over the past several years due to low interest rates. But high debt levels, which are rapidly rising as a percentage of GDP, slow the growth of economic output and recovery, lowering living standards over a period of years. Public debt diverts investment dollars away from the private sector and toward U.S. Treasury bonds, which are used to finance existing obligations of the government, not new private-sector initiatives. A growing debt burden could undermine confidence in the U.S. dollar, challenging the U.S. global leadership role, and making it more costly to finance public and private activity in international markets.

The Debt Crisis is here. The time is now for a bipartisan Fiscal Responsibility Commission to develop viable comprehensive solutions.

About the Authors

Dana M. Peterson is the Chief Economist and Leader of the Economy, Strategy & Finance Center at The Conference Board. Prior to this, she served as a North America Economist and later as a Global Economist at Citi, the world’s largest investment bank. Her wealth of experience extends to the public sector, having also worked at the Federal Reserve Board in Washington, D.C. Dana’s wide-ranging economics portfolio includes analyzing global themes having direct financial market implications, including monetary policy; inflation; labor markets; fiscal and trade policy; debt; taxation; ESG; consumption, and demographics. Her work also examines myriad US themes leveraging granular data. Peterson's research has been featured by US and international news outlets, both in print and broadcast. Publications and networks include CNBC, FOX Business, Bloomberg, Thomson-Reuters, CNN Finance, Yahoo Finance, TD Ameritrade, Barron’s, the Financial Times, and the Wall Street Journal. She is member of the Board of Directors of NBER, NABE, and the Global Interdependence Center, President of the New York Association for Business Economics (NYABE), and a member of NBEIC, the Forecasters Club, and the Council on Foreign Relations. She received an undergraduate degree in Economics from Wesleyan University and a Master of Science degree in Economics from the University of Wisconsin-Madison.

Dr. Lori Esposito Murray is President of the Committee for Economic Development of The Conference Board. Murray brings to CED extensive experience at the highest echelons of domestic and international policy. She most recently served as an adjunct senior fellow at the Council on Foreign Relations’ (CFR). Prior to her role at CFR, she held the distinguished national security chair at the U.S. Naval Academy. She also is president emeritus of the World Affairs Councils of America, the largest non-partisan, non-profit, grassroots organization dedicated to educating and engaging the U.S. public on global issues.

Murray's work in government crosses political parties and extends to both ends of Pennsylvania Avenue. Her multiple roles have included serving as special advisor to President Clinton on the Chemical Weapons Convention and as the assistant director for multilateral affairs at the State Department’s U.S. Arms Control and Disarmament Agency. Prior to that, Murray worked as executive director of the Department of Defense’s Federal Advisory Committee on Gender-Integrated Training in the Military and Related Issues. She also headed the congressionally mandated U.S.-China Security and Economic Review Commission, and was a consultant to President George W. Bush’s Commission on Weapons of Mass Destruction and U.S. Intelligence Capabilities.

Murray worked for almost a decade as national security advisor to Senator Nancy Landon Kassebaum (R-KS), a senior Republican member of the Senate Foreign Relations Committee. Her responsibilities included the full spectrum of U.S. national security: foreign policy, defense, intelligence, and trade issues. Earlier in her career, Murray served as the professional associate to the National Academy of Sciences, Committee on International Security and Arms Control.

Dr. Murray received her BA from Yale University and her PhD from The Johns Hopkins School of Advanced International Studies.

Expert Views

Fiscal Commission

We asked respected policy experts to share their views on a fiscal commission and recommend a comprehensive set of solutions.