You are here

President Biden’s Budget Calls for Raising $4.3 Trillion in Revenues Over Ten Years — Here’s How

On March 11, the Biden Administration released its budget proposal for the 2025 fiscal year. The budget includes a number of tax proposals that would increase revenues and reduce spending by $4.3 trillion over the next 10 years. Those proposals would offset increases in other spending also included in the budget, resulting in a net deficit reduction of $3.2 trillion over the decade. The most significant proposals would increase taxes on corporations and high-income taxpayers.

Tax proposals in the President’s budget for 2025 would generate $4.3 trillion over the next decade

| Category | Effect on Deficit from 2025–2034 (Billions) |

|---|---|

| Business Taxation | $2,069 |

| Taxation of High-Income Taxpayers | 1,955 |

| International Taxation | 632 |

| Extend Internal Revenue Service Funding | 341 |

| Close Tax "Loopholes" | 66 |

| Improve Tax Administration and Compliance | 66 |

| Modify Energy Taxes | 45 |

| Housing and Urban Development | -65 |

| Support Workers, Families, and Economic Security | -765 |

| Total | $4,344 |

SOURCE: Department of the Treasury, General Explanations of the Administration’s Fiscal Year 2025 Revenue Proposals, March 2024.

© 2024 Peter G. Peterson Foundation

Biden’s Proposed Changes to Business Taxation

The Administration’s proposed changes to business taxation would generate $2.1 trillion in revenues over the next 10 years by increasing tax rates, limiting tax deductions, and revising some tax rules. The most significant revenue-raising provisions would:

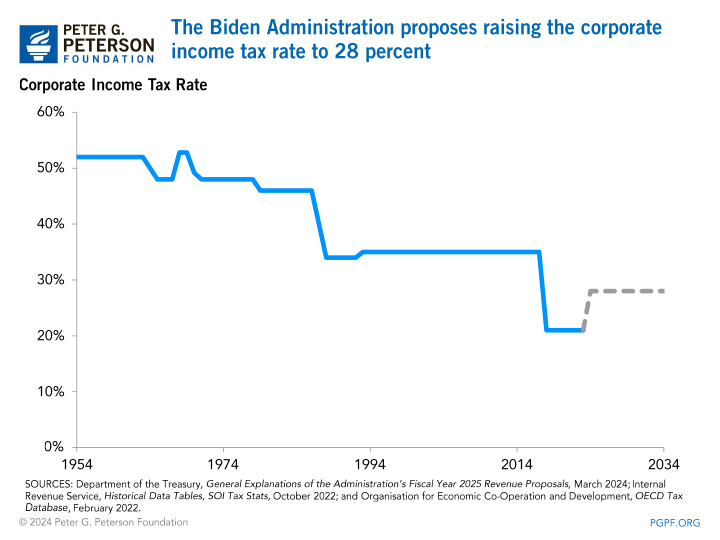

- Increase the corporate income tax rate to 28 percent: $1.3 trillion. The 2017 Tax Cuts and Jobs Act (TCJA) lowered the federal corporate income tax rate from 35 percent to 21 percent. The Biden Administration’s budget proposes increasing the current rate to 28 percent.

- Expand the limit on deducting employee compensation in excess of $1 million: $272 billion. Under current law, publicly held businesses are prohibited from deducting compensation in excess of $1 million for covered employees including CEOs, CFOs, and the three other highest paid employees. The proposal would expand that limitation to all employees making more than $1 million for all publicly and privately held C corporations.

- Increase the excise tax rate on stock buybacks to 4 percent: $166 billion. The Inflation Reduction Act of 2022 imposed an excise tax of 1 percent on corporate stock buybacks. The Administration’s proposal would increase that tax rate to 4 percent. It would also extend the excise tax for stock repurchases to affiliated controlled foreign corporations.

- Increase the corporate alternative minimum tax (CAMT) to 21 percent: $137 billion. Corporations use different methods of accounting for federal tax returns and financial statements reported to shareholders, which can result in differences in reported profits. As such, corporations are required to pay a minimum tax based on their profits reported to shareholders. Under current law, the CAMT is set to 15 percent of financial statement income. It would be increased to 21 percent under the President’s budget.

Biden’s Proposal to Tax High-Income Taxpayers

The President’s budget includes various provisions to reform the taxation of high-income taxpayers, in total raising $2.0 trillion over 10 years. By the Administration’s calculations, only taxpayers making more than $400,000 would be affected by the provisions — roughly the top 5 percent of earners. Revenues would be raised by increasing taxes on high-income earners, reforming capital income taxes, and modifying the taxation of estates and gifts. The most significant revenue raising provisions would:

- Reform additional Medicare taxes on high-income taxpayers: $797 billion. All wages and self-employment earnings are subject to the Medicare payroll tax at a rate of 2.9 percent, which is split equally between workers and employers or paid in full by the self-employed. High-income taxpayers — individuals with income over $200,000 and married couples over $250,000 — face an additional 0.9 percent Medicare tax, bringing their total Medicare tax rate to 3.8 percent. Those same high-income taxpayers are also subject to the net investment income tax (NIIT), which subjects most passive business income (such as interest, dividends, and certain rents) to an additional 3.8 percent Medicare contribution tax. The Administration proposed two reforms to those taxes. The first would increase the additional Medicare tax rate and the NIIT rate by 1.2 percentage points for taxpayers with income over $400,000, thereby increasing both the Medicare tax and NIIT rates to 5 percent for those taxpayers. The second would expand the tax base of the NIIT by expanding it to pass-through businesses — including S corporations and partnerships.

- Impose a minimum income tax on the wealthy: $503 billion. Currently, the federal government only imposes taxes on income, which includes wages, pass-through income from businesses, and gains from the sale of property; unrealized capital gains are not considered income under the present tax code. Applicable only to taxpayers with wealth greater than $100 million, the proposal would impose a minimum tax equal to 25 percent of a taxpayer’s taxable income and unrealized capital gains less the sum of their regular tax. The minimum tax payments would be treated as prepayments to be credited against future realized gains.

- Reform taxation of capital income: $289 billion. The Biden Administration proposed two reforms related to capital gains. The first would make the capital gains of taxpayers with income over $1 million taxable as ordinary income, increasing the tax rate from 20 to 37 percent. The second would largely eliminate the stepped-up basis. Currently, capital gains are not considered realized when transferred at death or by gift, and the recipient of the property receives a “stepped-up” tax basis, meaning the capital gains of the decedent or donor are never taxed. The proposal would reclassify transfers at death or by gift as a realization event for the decedent or donor. Such transfers would then be taxable, save for certain exceptions such as transfers to spouses or charitable organizations.

- Increase the top marginal income tax rate: $246 billion. The TCJA set the top marginal income tax rate to 37 percent, effective from 2018 through 2025. The proposal would return the top marginal rate to 39.6 percent starting in 2024.

Biden’s Proposed Changes to International Taxation

The Biden Administration proposed a series of reforms to the taxation of income derived from business overseas, in total raising $632 billion over 10 years. The most significant reforms would center on the global minimum tax regime, which governs how income from controlled foreign corporations (CFCs) are taxed. Among other reforms to the tax regime, the minimum effective tax rate for CFCs would increase from 10.5 percent to 21 percent. In total, the package of reforms to the global minimum tax regime would raise $374 billion.

Extend Internal Revenue Service Funding

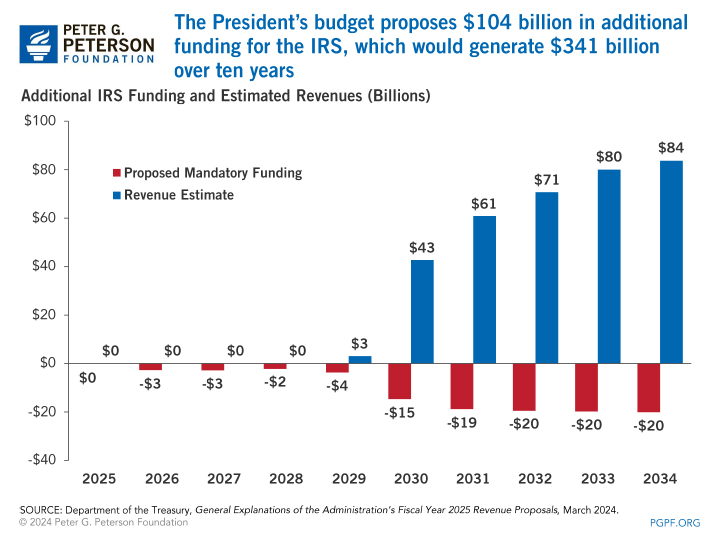

In 2022, lawmakers provided about $80 billion in additional funding to the Internal Revenue Service through the Inflation Reduction Act, which remains available from 2022 to 2031. Initial estimates from the Congressional Budget Office indicated that the additional funding would yield $186 billion in new revenues from 2022–2032, mostly through enhanced operations support and enforcement activities aimed at closing the tax gap. The proposal would provide an additional $104 billion in funding from 2026 through 2034, $83 billion of which would be dedicated to operations support and enforcement. The Department of the Treasury estimated that the additional funding would generate $341 billion in revenues over 10 years.

Biden’s Proposals to Support Workers, Families, and Economic Security

Tax provisions of the Administration’s budget intended to support workers, families, and economic security would increase deficits by $765 billion over the upcoming decade, mostly through reform of certain tax credits. Almost all of the tax benefits from the provisions would stem from restoring COVID-19 related expansions of the child tax credit (CTC), health insurance premium tax credits, and the earned income tax credit.

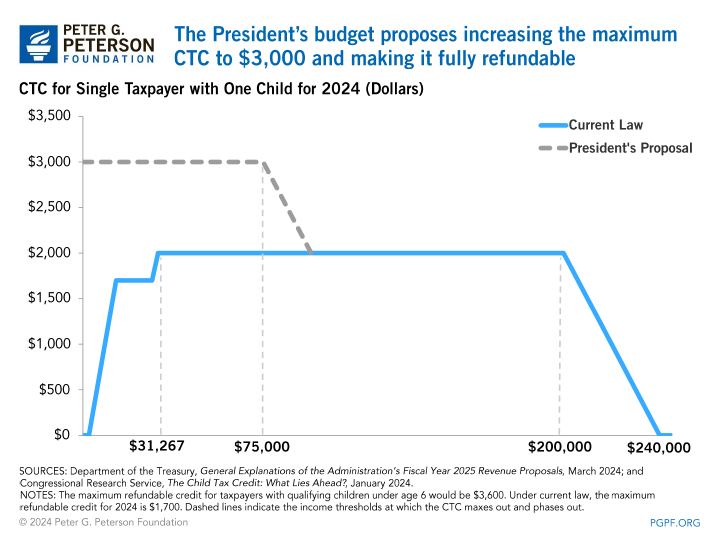

- Expand the child tax credit: −$310 billion. For tax years from 2024 through 2025, the provision would increase the maximum CTC from $2,000 to $3,600 per qualifying child under age 6 and $3,000 for all other children, and the credit would be fully refundable beginning in 2024. That increase would then begin to phase down to $2,000 for those with higher income: $75,000 for single filers and $150,000 for joint filers. The proposal would also raise the maximum age for a qualifying child from 16 to 17 years old. Beginning in 2025, taxpayers would be able to receive the CTC through a series of advance monthly payments rather than a lump sum upon filing their tax return.

- Make permanent the expanded health insurance premium tax credits:

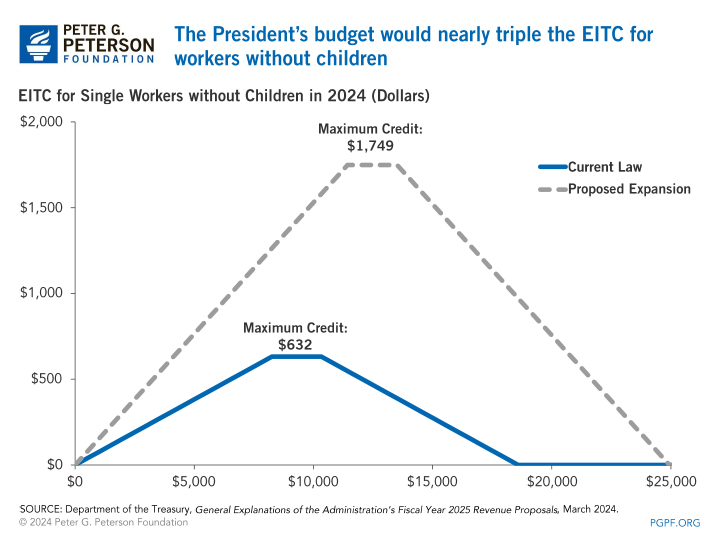

−$230 billion. Premium tax credits are available to certain individuals who purchase health insurance through the marketplaces established under the Affordable Care Act. In response to the COVID-19 pandemic, lawmakers expanded eligibility for such tax credits and lowered the mandatory premium contribution percentages under the American Rescue Plan Act of 2021. The more generous credits were then extended through 2025 by the enactment of the Inflation Reduction Act of 2022. Currently, credits are generally available to those with household income above 100 percent of the federal poverty line and who are not eligible for affordable coverage through an employer-sponsored plan or a government program. If the expanded credits were to expire, it would only be available to those with income between 100 and 400 percent of the poverty line, and premium contribution percentages would increase from 0.0–8.5 percent to 2.0–9.5 percent. The proposed budget would make the expanded income eligibility and lower premium contribution percentages permanent. - Permanently expand the earned income tax credit for workers without children: −$163 billion. Under the American Rescue Plan, lawmakers expanded the earned income tax credit for workers without children, but the expansion only applied to taxes for 2021. The Administration proposes restoring and making permanent that expansion. If enacted, the provision would nearly triple the maximum credit for workers without children in 2024 — from $632 to $1,749 — and the maximum income eligible for the full credit would increase from $10,330 to $13,510 for single filers and $17,250 to $24,940 for joint filers. The minimum age eligibility would also decrease under the proposal, from at least age 25 to either age 19 or age 24 if the taxpayer is a full-time student.

The Administration’s Other Tax Proposals

The Biden Administration also proposed a package of reforms that would close certain tax “loopholes,” improve tax administration and compliance, modify energy taxes, and support housing and urban development. The most significant item would modernize rules for digital assets to make them similar to current rules for stocks and securities, which would raise $42 billion over the next 10 years. Other notable provisions include:

- Modify energy taxes to eliminate preferences for fossil fuels: $35 billion.

- Place a cap on the deferral of gains from real estate: $20 billion.

- Expand the low-income housing credit to increase the housing supply: −$37 billion.

In all, “other” provisions would increase revenues by $112 billion on net over a decade.

Fiscal Responsibility for the Future

While a President’s budget is never enacted in full, it is an important part of the budget process that outlines the Administration’s priorities and furthers a critical debate about fiscal choices. The revenue provisions of the President’s budget would make significant progress in reducing federal deficits over the next decade, but deficits would persist and the national debt would continue to rise to unsustainable levels under the plan. While the President’s plan would be a step in the right direction, policymakers need to come together to enact comprehensive solutions to stabilize the debt and put the federal government on a fiscally responsible path.

Related: President’s Budget Would Reduce Deficits By Raising Taxes On The Wealthy And Corporations

Image credit: Photo by Getty Images