Significant damage was done to America’s fiscal outlook over the past year. New legislation passed by Congress and signed by the President has widened the gap between revenues and spending, and has taken our fiscal condition from bad to worse. Unpaid-for tax cuts and new spending legislation means we will return to trillion-dollar deficits as early as next year. Interest on the national debt cost taxpayers $325 billion in 2018 and is projected to total nearly $7 trillion over the next decade — squeezing out national priorities, investments in our economy, and programs that are relied upon by millions of Americans.

The following nine charts tell the fiscal story of 2018, illustrating the damage done and the urgent need to correct course to secure economic opportunities and quality of life for every American in the future.

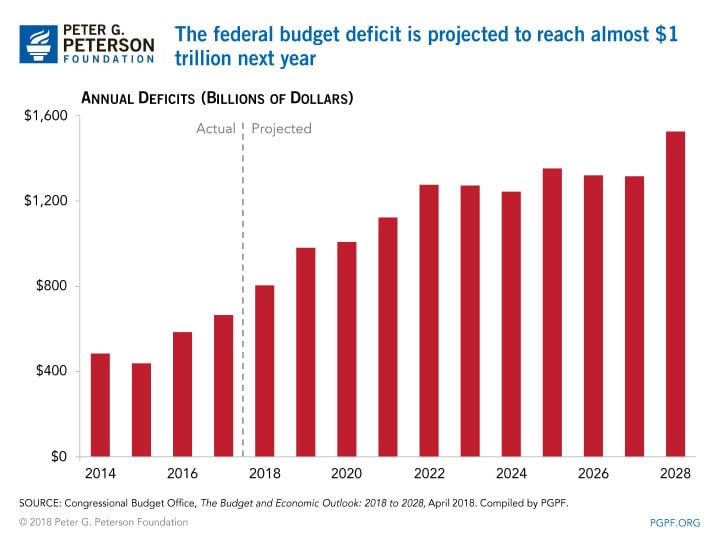

1. We’re back to trillion-dollar deficits.

The nonpartisan Congressional Budget Office (CBO) projects that the deficit for this fiscal year will reach $973 billion, and deficits are projected to continue climbing in the years ahead. Other than during the Great Recession and its aftermath, the U.S. government has never witnessed deficits over $1 trillion.

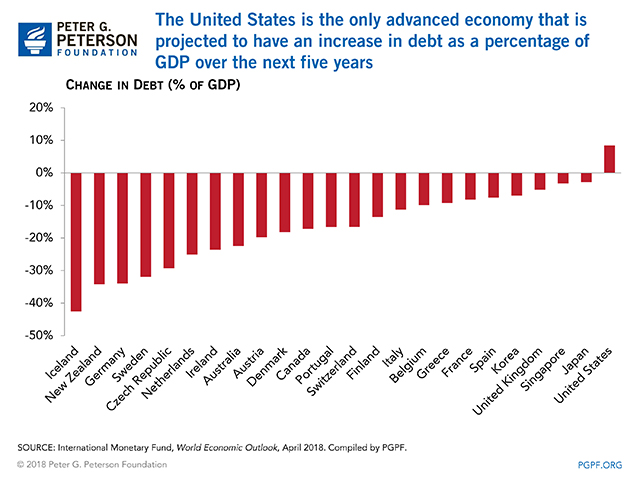

2. It’s unusual for debt to increase faster than the economy during a period of strong growth.

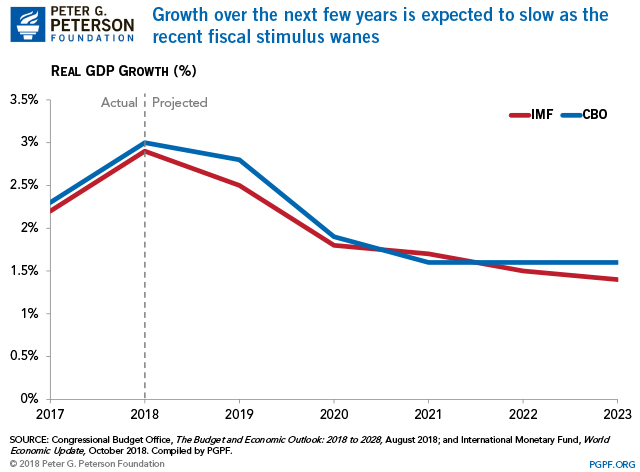

3. This economic growth is unlikely to last.

The GDP-boosting effects of the Tax Cuts and Jobs Act (TCJA) are expected to fade by 2020, according to forecasters, and long-term economic growth is projected to decline due to our aging population and slowing labor productivity.

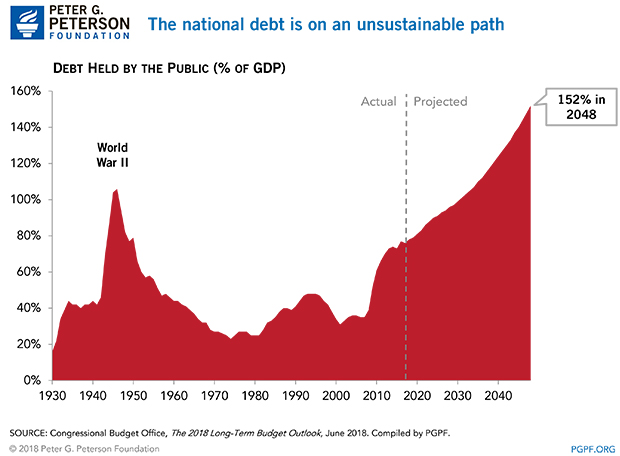

4. Federal debt is already near its highest level as a percentage of GDP since 1950.

On this path, debt would exceed its all-time high by 2034 under current law, according to projections from the Congressional Budget Office. Rising deficits are only exacerbating what was an already unsustainable fiscal path.

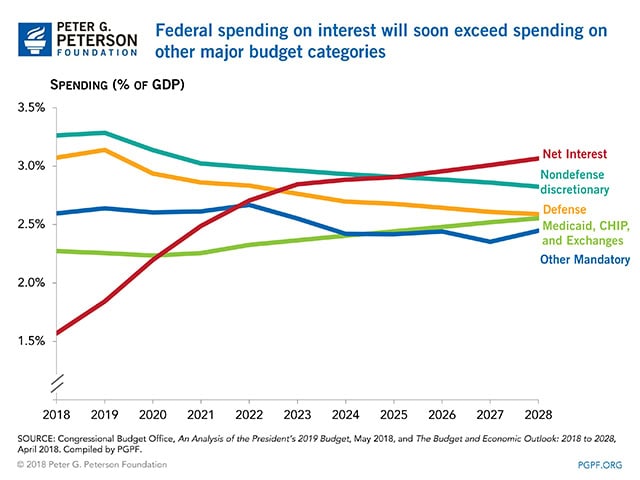

5. Interest payments on the debt will start squeezing spending on programs that Americans care about.

Net interest costs on the debt will total nearly $7 trillion over the next decade. Next year, interest costs will surpass what the federal government spends on children, and by 2023, it will exceed defense spending.

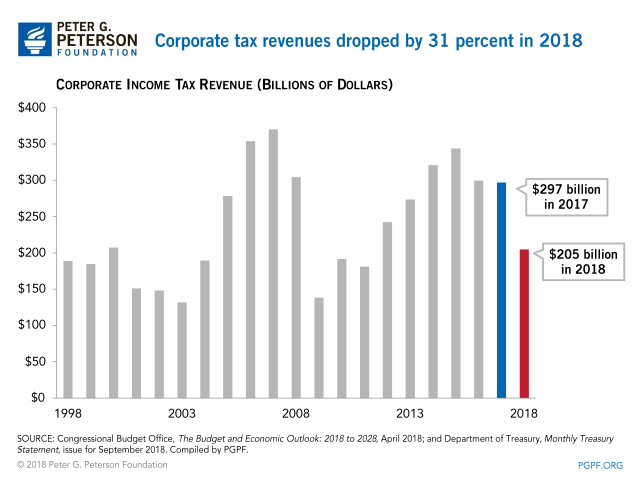

6. Deficits were higher in 2018 in part because the TCJA took a big bite out of corporate tax revenues.

The year-over-year drop in corporate tax payments in fiscal year 2018 was 31 percent. Such a large drop is unprecedented during a time of economic growth.

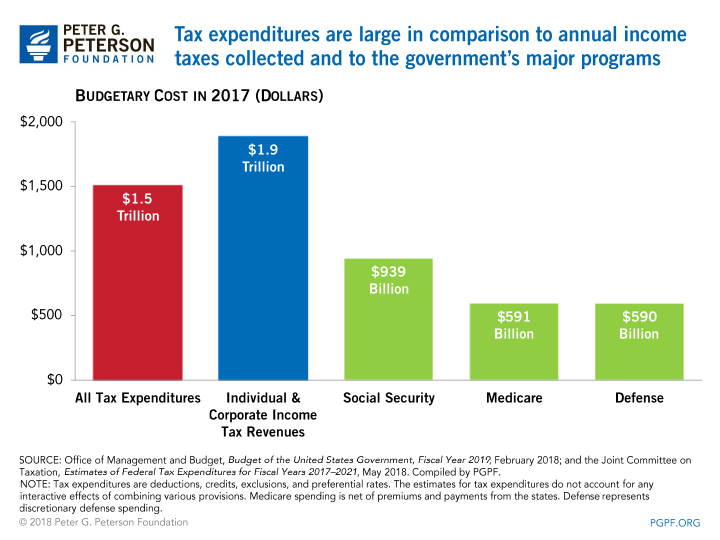

7. Not only did the TCJA reduce revenues, it also failed to simplify the tax code.

According to the Joint Committee on Taxation, there were a total of 216 tax breaks before the TCJA. Now, after TCJA's implementation, there are 223. Tax breaks, or tax expenditures, are like government spending in disguise and overall dwarf spending on major programs.

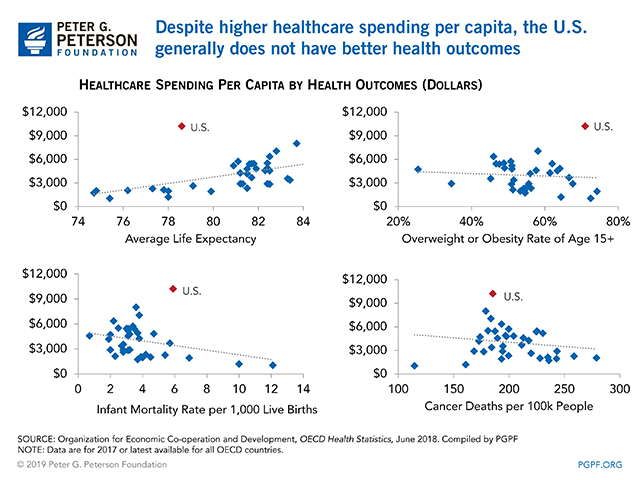

8. Healthcare costs continue to rise and are one of the key drivers of government spending.

Public and private spending on healthcare is increasing because our population is aging and prices for medical care are growing faster than inflation. Although the United States spends significantly more on healthcare per person than other developed countries, we aren’t healthier, and even lag behind other countries in common health metrics.

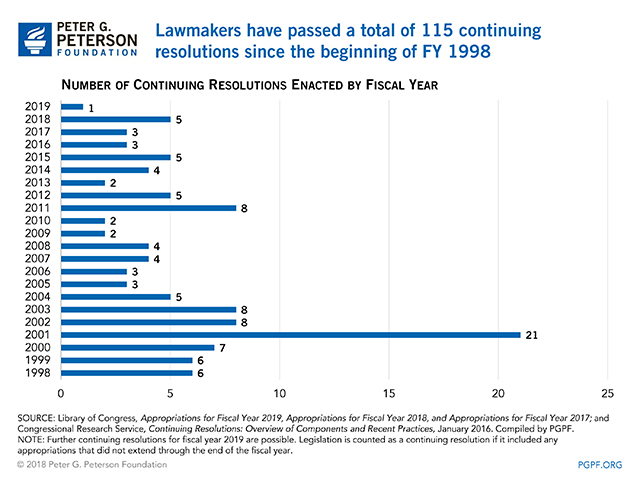

9. Congress missed a key opportunity to reform the broken budget process.

The repeated failure to pass annual appropriations on time is a reflection of the broken budget process. Unfortunately, lawmakers missed a key opportunity when the Joint Select Committee on Budget and Appropriations Process Reform dissolved without reporting even modest recommendations.

Getting our fiscal house in order is essential for setting and carrying out our national priorities. Doing so could boost economic opportunity and the quality of life for millions of Americans, which in turn can fuel economic growth for generations to come. Stabilizing the federal debt could increase family incomes substantially, according to CBO data.

Further Reading

Top 10 Reasons Why the National Debt Matters

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.