You are here

The Fiscal &

Economic Impact

A strong fiscal outlook is an essential foundation for a growing, thriving economy. Putting our nation on a sustainable fiscal path creates a positive environment for growth, opportunity, and prosperity. With a strong fiscal foundation, the nation will have increased access to capital, more resources for future public and private investments, improved consumer and business confidence, and a stronger safety net.

However, if we fail to act, the opposite is also true. Suppose our long-term fiscal challenges remain unaddressed, and our economic environment weakens as confidence suffers. In that case, access to capital is reduced, interest costs crowd out key investments in our future, the conditions for growth deteriorate, and our nation is put at greater risk of economic crisis. If our long-term fiscal imbalance is not addressed, our future economy will be diminished, with fewer economic opportunities for individuals and families and less fiscal flexibility to respond to future crises.

Rising debt threatens America’s future in several critical ways:

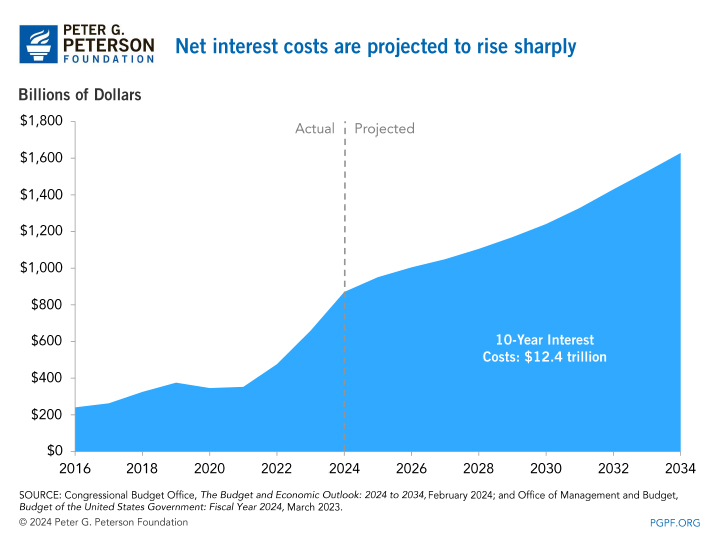

Reduced Public Investment. As the federal debt mounts, the government will spend more of its budget on interest costs, increasingly crowding out public investments. Over the next 10 years, the Congressional Budget Office (CBO) estimates that interest costs will total $12.4 trillion under current law. Currently, the United States spends $2.4 billion per day on interest payments.

As more federal resources are diverted to interest payments, there will be less available to invest in areas that are important for economic growth. With interest rates currently higher than they have been for the past decade, the federal government's borrowing costs will increase markedly. Within 30 years, CBO projects that interest costs will be the largest federal spending “program” and would be nearly three times what the federal government has historically spent on R&D, non-defense infrastructure, and education combined.

Reduced Private Investment. Federal borrowing competes for funds in the nation’s capital markets, thereby raising interest rates and crowding out new investments in business equipment and structures. Entrepreneurs face a higher cost of capital, potentially stifling innovation and slowing the advancement of breakthroughs that could improve our lives. At some point, investors might begin to doubt the government’s ability to repay debt and could demand even higher interest rates — further raising the cost of borrowing for businesses and households. Over time, lower confidence and reduced investment would slow the growth of productivity and wages of American workers.

Fewer Economic Opportunities for Americans. Growing debt also directly affects the economic opportunities available to every American. If high levels of debt crowd out private investments in capital goods, workers would have less to use in their jobs, which would translate to lower productivity and, therefore, lower wages. On the other hand, reducing federal borrowing would counter such effects; according to CBO, income per person could increase by as much as $6,300 by 2050 if we were to reduce our debt to 79 percent of the size of the economy by that year.

In addition, high levels of debt would affect many other aspects of the economy in the future. For example, higher interest rates resulting from increased federal borrowing would make it harder for families to buy homes, finance car payments, or pay for college. Fewer education and training opportunities stemming from lower investment would leave workers without the skills to keep up with the demands of a more technology-based, global economy. Faltering support for research and development would make it harder for American businesses to remain on the cutting edge of innovation and would hurt wage growth in the United States. Furthermore, slower economic growth generally would also make our fiscal challenges even worse, as lower incomes lead to smaller tax collections and put the federal budget further out of balance. Vital safety net programs would come under even greater budgetary pressure, threatening support for those who need them most.

Greater Risk of a Fiscal Crisis. If investors lose confidence in the nation’s fiscal position, interest rates on federal borrowing could rise as higher yields would be demanded to purchase such securities. A rapid increase in Treasury rates could also lead to higher rates of inflation, which would reduce the value of outstanding government securities and result in losses by holders of those securities — including mutual funds, pension funds, insurance companies, and banks — which could further destabilize the U.S. economy and erode confidence in U.S. currency on an international scale.

Challenges to National Security. Our fiscal security is also closely linked to our national security and ability to maintain a leading role in the world. As Admiral Mullen, former Chairman of the Joint Chiefs of Staff, put it: “The most significant threat to our national security is our debt.” As the national debt grows, we are more beholden to creditors around the globe and have fewer resources to invest in strength at home.

Imperiling the Safety Net. America’s high debt jeopardizes the safety net and the most vulnerable in our society. If our government does not have the resources and stability of a sustainable budget, those essential programs and the individuals who need them most are put in jeopardy.