You are here

CBO’s August 2010 Budget Outlook

Budget Outlook

The Congressional Budget Office (CBO) released its update of the Budget and Economic Outlook on August 19, 2010. At $1.3 trillion — or 9 percent of gross domestic product (GDP) — CBO estimates that the 2010 deficit will be slightly lower than last year’s $1.4 trillion (10 percent of GDP). The updated 2010 projection is a slight improvement over CBO ‘s March estimate primarily as a result of higher than expected corporate revenues and receipts from the Federal Reserve. By 2012, CBO projects that the federal deficit will decline to below half of this year’s level, to about 4 percent (GDP), and drop further to 2 percent of GDP by 2014. However, as deficits persist, CBO projects growing debt levels over the next decade. Under current law, debt is expected to rise from $9.0 trillion this year to $16.1 trillion by 2020. Throughout CBO’s 10-year projection period U.S. debt is expected to exceed 60 percent of GDP, the ceiling allowed by the European Monetary Union. By 2020, CBO project that the debt will be nearly 70 percent of GDP.

CBO’s projections serve as a neutral benchmark for lawmakers to measure the potential impacts of proposed policy. By law, CBO is required to construct budget projections that reflect current law, no matter how likely some provisions are to change. As a result, CBO’s baseline August budget projections may present an overly optimistic perspective about the budget’s future path. For example, the baseline assumes:

- Tax cuts originally enacted in the Economic Growth and Tax Relief Reconciliation Act of 2001(EGTRRA) and the Jobs and Growth Tax Relief Reconciliation Act 2003 (JGTRRA) expire as scheduled;

- Relief from the Alternative Minimum Tax (AMT) contained in the Recovery Act expires as scheduled

- To stabilize the federal debt at its current level of 62 percent of total economic output, or gross domestic product (GDP), taxes would have to immediately and permanently increase by almost 15 percent, spending would have to be slashed permanently by 13 percent, or some combination of the two. If the health care cost control measures contained in the Affordable Care Act are not sustainable in the long run, by 2034, debt held by the public will exceed 200 percent of GDP and interest payments to service the public debt will reach 9 percent of GDP.

- Discretionary spending will increase at the rate of inflation.

Economic Outlook

The future direction of the economy represents the greatest element of uncertainty about the nation’s fiscal outlook. Compared to other post-recession recoveries, CBO projects that economic growth will remain sluggish and the recovery will progress slowly. Unemployment will remain above 9 percent in 2011 but steadily decline to just below 6 percent by 2014. CBO projects that the economy will grow only 2 percent between the last quarter of 2010 and the end of 2011. GDP growth is projected to average 4.1 percent between 2012-2014. This is compared to the 4.4 percent growth projected in CBO’s January report. Growth will then slow to an annual average of 2.4 percent between 2015-2020. Inflation is projected to remain under 1.7 percent until 2013, and then rise slightly, to average 2.3 percent annually between 2015-2020.

The PGPF Alternative Budget Scenario

To obtain a better understanding of the budget’s future course, the Peterson Foundation has prepared an alternative budget scenario that includes highly plausible policy changes. Overall, the substantial decline in deficits over the ten-year budget window and the relatively restrained growth in debt held by the public is almost entirely a result of the assumed expiration of the 2001 and 2003 tax cuts. Currently, the debate in Washington about the tax cuts has focused on extending all of the tax cuts or only some of the tax cuts. Congress has routinely passed temporary alternative minimum tax (AMT) relief and patches to the SGR formula to prevent the current law provisions to take effect. PGPF has prepared this alternative scenario to present a more realistic picture of the deteriorating fiscal outlook by incorporating likely policy changes.

In our scenario, primary spending and debt service costs are significantly higher that the CBO baseline. Tax revenues are also significantly lower. We have made the following adjustments:

- The 2001 and 2003 tax cuts and fixes to the AMT: Our alternative scenario adopts the Obama administration’s proposal to extend the tax cuts for families making under $250,000 and single filers making less than $200,000, the tax cuts will expire only for the highest earners beginning in 2012. In addition, our scenario continues the inflation adjustments for the thresholds at which taxpayers are subject to the AMT. Otherwise, more and more taxpayers will have to pay the AMT.

- Fixes to the Sustainable Growth Rate (SGR) formula: Our scenario assumes that the cuts to physicians’ Medicare reimbursement rates currently scheduled under the SGR formula will not take place. Instead, we adopt an option that replaces the SGR with the Medicare Economic Index (MEI) and allows reimbursement rates to grow with the cost of inputs and an adjustment for increased productivity.

- Military Operations in Iraq and Afghanistan: Our scenario assumes that troop levels in Iraq and Afghanistan will be drawn down to 60,000 troops. Unlike other changes built into the baseline, this option represents a decrease in federal spending and improves the budget outlook.

- Other discretionary spending: Our scenario assumes that discretionary spending will increase at the rate of growth of GDP, rather than inflation (as assumed in the CBO baseline).

- Debt Service: Our alternative assumptions increase outlays and decrease revenues, leading to larger deficits and debt levels, compared to the CBO baseline. As a result, our scenario has higher deficits and a higher debt level than CBO’s baseline. Because of these changes, our scenario has higher interest costs on the debt.

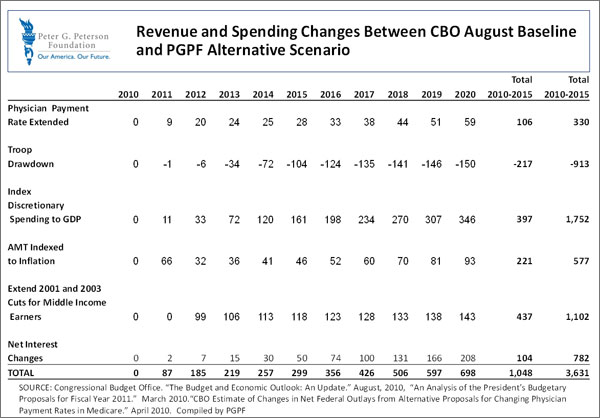

Figure 1. Budgetary Impacts of Policy Options Included in Alternative Scenario Budgetary Impacts of Policy Options Included in Alternative Scenario

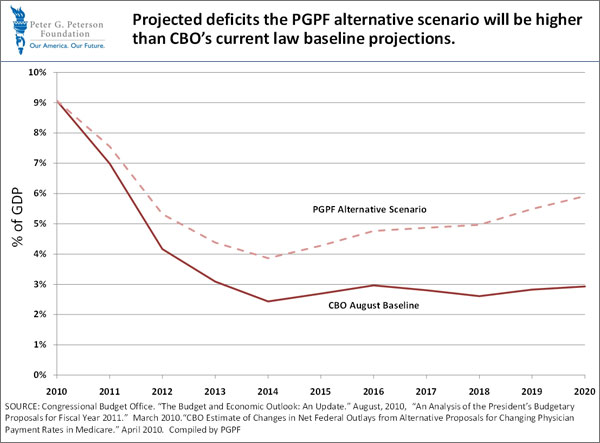

Under PGPF scenario, the cumulative deficit is $3.6 trillion higher over the 10-year period than CBO’s August baseline (See Figure 1). The federal budget deficit would reach 5.9 percent of GDP in 2020, more than twice as large as the deficit under the CBO’s current law baseline assumptions.

Figure 2. Comparison of Projected Deficits under the PGPF Alternative Scenario and CBO’s August 2010 Baseline

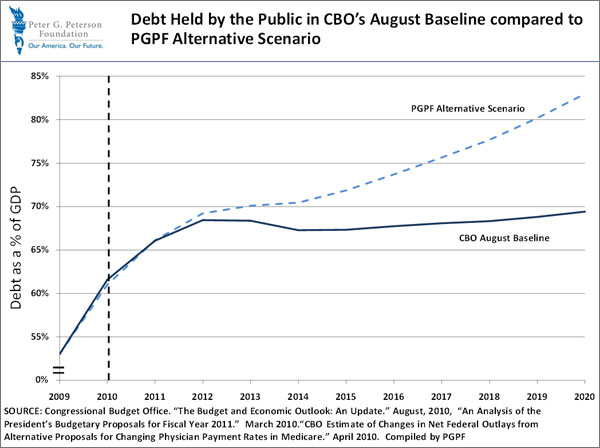

Debt held by the public is projected to increase as the federal government continues to finance deficits with borrowing. Under the alternative scenario, the debt-to-GDP ratio will grow much faster than the CBO baseline— reaching 83 percent of GDP in 2020 (see Figure 3). The interest costs associated with that debt will also grow — exceeding 4 percent of GDP in 2020.

Figure 3. Comparison of Projected Debt under the PGPF Alternative Scenario and CBO’s August 2010 Baseline

To put this into perspective, the alternative baseline assumes that in 2020 total spending on national defense will be approximately 4.4 percent of GDP. By 2020, interest costs will be greater than spending for Medicare.

Conclusion

Although short-term deficits resulting from the recession help to offset the slow pace of economic activity, the CBO’s August report reveals a permanent and growing mismatch between revenues and spending. Persistent deficit spending and increased borrowing from the public raises the risk that investment in private capital stocks would be "crowded out." Government debt is a relatively safe and desirable place for investors to put their money, but a dollar parked in the Treasury is a dollar unavailable for private investment. With less private investment, productivity could drop, stalling future economic growth. This crowding out effect would place more strain on an already slow economic recovery and lower future standards of living.

PGPF’s alternative scenario represents a more challenging perspective than the current law baseline provided by CBO. Our assumptions incorporate likely changes to revenue and spending policies. Under our assumptions, deficits will be larger and debt held by the public will grow faster than under the current law baseline. The cost of servicing these debts will continue to grow as a portion of the federal budget placing more pressure on an already strained budget process.

Both the CBO’s current law baseline and the PGPF alternative scenario underscore the long -term structural imbalance of the federal budget. Once the economy recovers, reforms that would place the budget on a sustainable path are needed to address this imbalance and improve the future outlook for the budget and the overall economy.