You are here

Federal Budget Deficits Rising — Even Before Tax Cuts

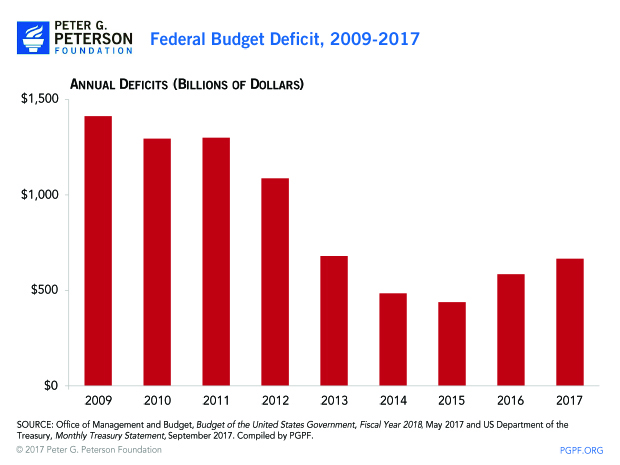

The Treasury Department announced last week that the federal budget deficit rose to $666 billion for fiscal year 2017 — an increase of around $80 billion from the previous year. In 2017, the amount of revenue the federal government collected totaled $3.3 trillion, while the amount it spent totaled nearly $4 trillion.

Fiscal year 2017 marks the second year in a row that the deficit has risen. For the six years before that, the deficit generally fell — from $1.4 trillion in 2009 to $438 billion in 2015 — as economic conditions improved and some legislative changes were implemented. However, slow revenue growth and rising outlays driven by spending for the elderly, health care, and interest — as well as by quirks in the timing of certain payments — drove the deficit upward in 2016. CBO estimates that deficits will once again eclipse $1 trillion annually by 2022, assuming that current law remains the same. Other observers have projected that milestone could occur as early as 2020 if tax cuts are enacted and spending on disaster relief continues to grow.

The reappearance of rising deficits highlights the need to put our long-term fiscal trajectory on a sustainable path. It also reinforces the point that as lawmakers consider a new framework for the tax code, they should ensure that tax reform is fiscally responsible. The loopholes, deductions and preferential rates in the current tax code are ripe for reform. And doing so will help remove distortions in decision-making that could have positive economic effects in the future.