You are here

The Fiscal &

Economic Challenge

America’s fiscal health and economic strength are closely linked. A strong fiscal foundation creates conditions that encourage economic growth: an environment with greater access to capital, increased public and private investments, enhanced business and consumer confidence, and a solid safety net. In turn, those factors improve the lives of Americans by supporting a vibrant economy with rising wages and greater opportunity, productivity, and mobility.

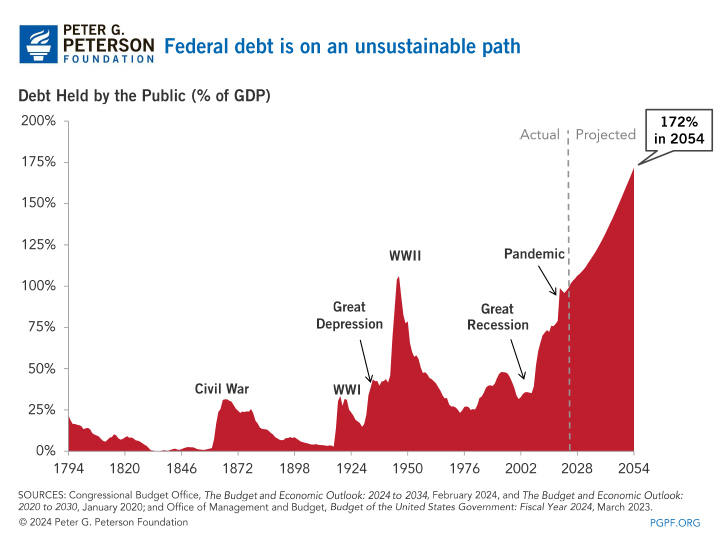

Unfortunately, America remains on an unsustainable fiscal path, which has been exacerbated by the economic effects of the coronavirus pandemic and the legislative response to mitigate them. Debt is already at its highest level since just after World War II and annual deficits are on an upward trajectory for the years to come.

Our Current Fiscal Path

The national debt is nearly the size of the entire economy and could rise to 172 percent of gross domestic product (GDP) by 2054 if current laws remain the same, according to the Congressional Budget Office (CBO). That level of debt would far exceed the 50-year historical average of 47 percent of GDP.

Drivers of the Debt

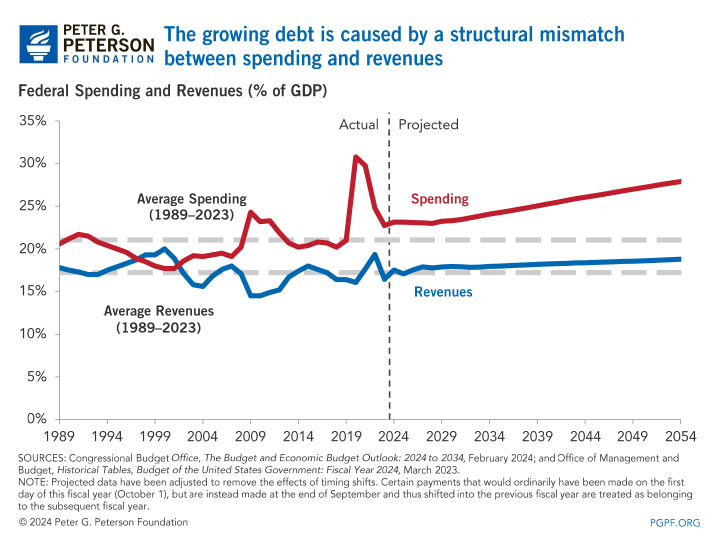

What is causing the growth of our national debt? The pandemic accelerated an unsustainable fiscal trajectory, but debt was already growing because of a fundamental imbalance between spending and revenues that will continue to grow in future years. CBO anticipates that federal spending will rise from 23.1 percent of GDP in 2024 to 27.9 percent in 2054. Revenues are projected to increase slightly during that period, from 17.5 percent of GDP in 2024 to 18.8 percent in 2054 — which would put the federal government further behind the spending commitments that have been made.

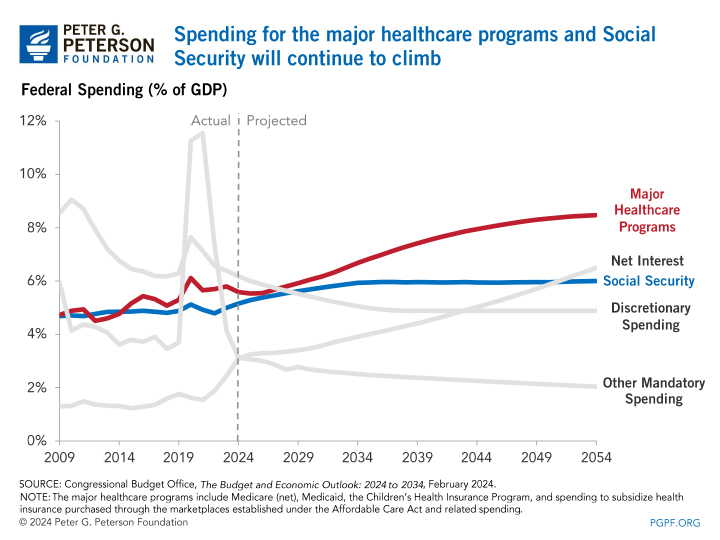

There are three drivers of the growth in spending: rising healthcare costs per capita, America’s aging population, and rapidly escalating interest costs.

CBO’s projections anticipate that the federal government’s spending on major healthcare programs, such as Medicare and Medicaid, will climb from 5.6 percent of GDP in 2024 to 8.5 percent in 2054. Additionally, the Centers for Medicare & Medicaid Services notes that healthcare spending by all sectors of the economy — government, business, and consumers — already totaled 17.3 percent of GDP in 2022 and will continue rising in the future.

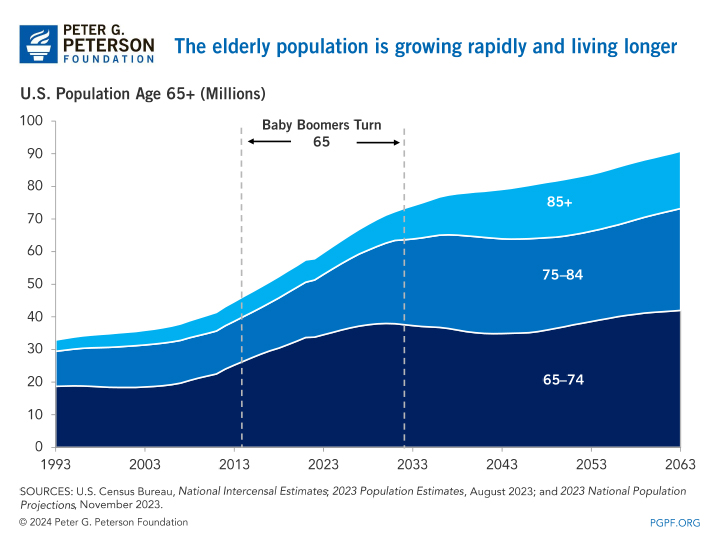

The second significant driver of spending is America’s changing demographics. The first wave of the baby-boom generation has already reached retirement age. In addition, Americans are living longer, on average, which means that seniors will spend more years in retirement.

In the coming decades, those factors will add substantially to the number of people supported by programs targeted to older Americans, such as Social Security and Medicare. By 2033, when CBO estimates that the Old-Age and Survivors Insurance (OASI) Trust Fund will be depleted, the number of beneficiaries is projected to total about 70 million people, or about 24 percent more than in 2022. Over the same period, the number of workers paying taxes to support each OASI beneficiary will decline from 3.2 to 2.7.

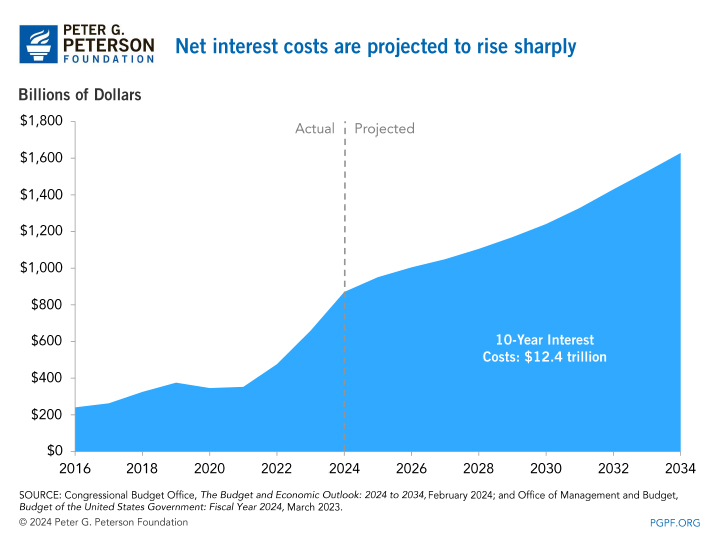

One of the most damaging effects of rising debt will eventually be rapidly growing interest costs. As the national debt grows and interest rates rise from their current low levels, the United States will spend more of its budget on the cost of servicing that debt — crowding out opportunities to invest in the economy. Additionally, interest costs will become the fastest-growing component in the federal budget and will total $12.4 trillion in the next 10 years alone, according to CBO.

Why Debt Matters

With retirement and healthcare programs growing faster than tax revenues, our fiscal outlook is unsustainable — and that will affect our economy. Within the budget, rising interest costs will squeeze other federal programs that protect the most vulnerable Americans and those that support future growth (like education, infrastructure, and research and development). Increased federal borrowing also crowds out private investment, which will reduce future income relative to what would otherwise occur. In addition, high levels of debt limit the ability of the government to respond to future challenges and increase the possibility of a fiscal crisis in the future.

The good news is that this problem is solvable. We can choose a better path — a path of stabilized debt, faster economic growth, broader prosperity, and enhanced economic opportunity and mobility.

The content in this section examines our long-term fiscal challenges in greater detail, including the major drivers and the fiscal and economic impacts of failing to act.