You are here

What is Free College and How Much Would It Cost?

Higher education can help students attain greater lifetime earnings and provide economic benefits to society. However, going to college is increasingly expensive, and the high cost is contributing to a rapid growth in student debt and a growing financial burden on Americans. To help expand access to and reduce the cost of college education, many policymakers and advocates have put forward nationwide “free college” proposals.

While the United States does not currently have a nationwide free college program, a number of such initiatives have been proposed in the past few years. During the 2020 Presidential campaign, for example, Senators Bernie Sanders and Elizabeth Warren each proposed a debt-free program. More recently, the Biden Administration proposed making community college tuition free as part of the American Families Plan. This piece provides an overview of different types of free college programs, the potential budgetary cost and distributional impact of such initiatives, and arguments for and against a nationwide program.

Approaches to Free College Programs

Free college programs generally refer to initiatives that reduce a student’s cost of attending college, which typically includes tuition as well as living expenses such as room and board. However, free college programs can vary greatly by factors like the amount of tuition and other expenses included, the type of institutions covered (public vs private), the enrollment criteria for the student (full-time vs part-time), and any eligibility requirements (such as income caps or minimum grade requirements). Below are some of the most common types of programs, grouped by how they cover a student’s tuition and other costs of attendance. To illustrate how each program works, we use an example where tuition costs $10,000, room and board costs $12,000, and a student receives $7,000 in grant aid (scholarships and grants that don’t have to be paid back).

- Last-dollar tuition-free programs mean that the government would pay any tuition remaining after the student’s grant aid is applied. In the example above, the $7,000 of grant aid would be applied to the cost of tuition and the government would cover the remaining $3,000 of the tuition bill. The student would be responsible for covering the $12,000 cost of room and board.

- First-dollar tuition-free programs mean that the government would pay for tuition before any grant aid is applied and the student can use that aid to cover other costs of attendance. In the same example, the government would pay the $10,000 tuition bill in full and the $7,000 in grant aid would partially cover the cost of room and board. The student would be responsible for covering the remaining $5,000 cost of room and board.

- Debt-free programs mean that the government would cover the full cost of attendance. Using the same example as before, the government would cover the $10,000 tuition bill as well as the $12,000 cost of room and board. In this example, students eligible for the program would not receive any grant aid since the entire cost of attendance is covered.

Generally, debt-free programs would generate the highest cost to the government and the lowest cost to the student; last-dollar programs would place more of a financial burden on the student. Programs can also be a hybrid of the types mentioned above.

Are There Currently Any Free College Programs in the United States?

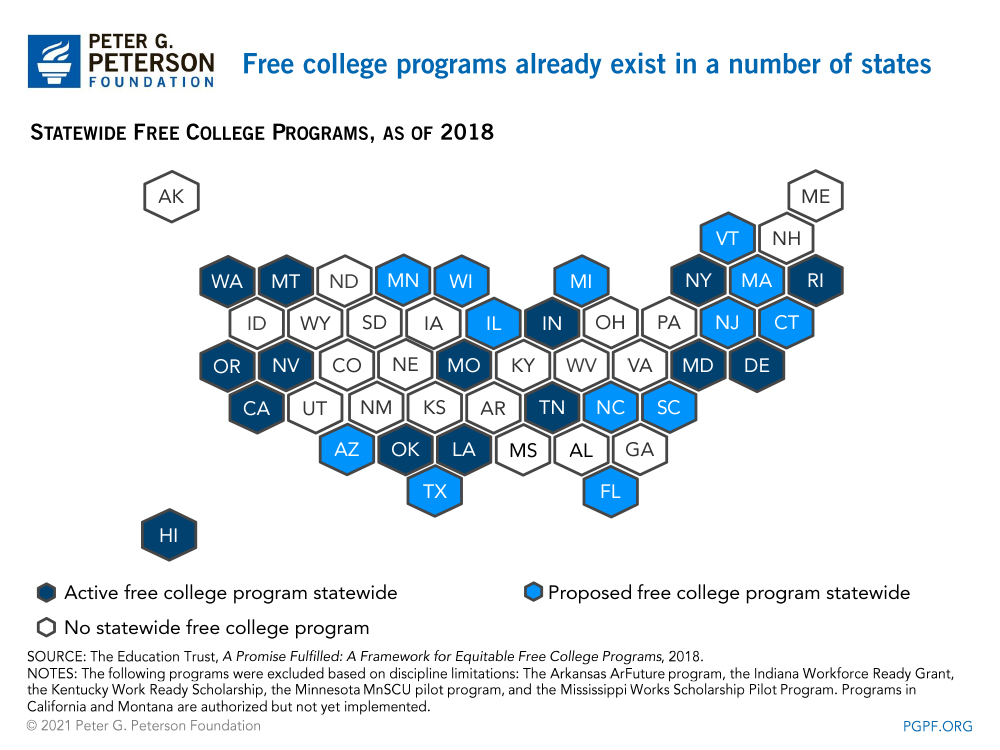

The United States currently does not have a nationwide system for free college, but some state and local governments have programs that provide free post-secondary education.

The Tennessee Promise, for example, is a last-dollar program enacted in 2015 that covers tuition for state residents attending community colleges or other associate degree programs in Tennessee. Another example is New York’s Excelsior Scholarship program — a last-dollar program that covers tuition for state residents at certain two- and four-year schools in New York, but restricts eligibility to families earning less than $125,000 annually.

One of the first local programs was the Kalamazoo Promise in Michigan, a first-dollar program established in 2005 to provide tuition payments to in-state colleges for students graduating from the Kalamazoo School District. While the full economic impact of the program is still unknown, the program has a number of pros and cons. On one hand, the program increased college enrollment, degree attainment, and earnings for program recipients — an analysis by the Upjohn Institute found that for every $1 paid in benefits, the average eligible student can expect to earn more than an additional $4. It also yielded some economic benefits for the area, such as more state funding for the district and the construction of new schools. On the other hand, the program by itself is limited and hasn’t been enough to overcome some of the area’s key challenges. For example, Kalamazoo still faces high rates of poverty and inequality, and there is little evidence that the program has improved social mobility in the area. Likewise, the increase in college completion rates due to the program has been largely been concentrated among students in white and mid- to high-income families.

As of 2018, about 15 states and an estimated 350 localities had some version of a free college program — and many other state and local governments had proposed such programs.

How Much Would a Nationwide Free College Program Cost?

The public cost of a nationwide free college program would vary depending on the type and scope of the program. The Georgetown University Center on Education and the Workforce (CEW) calculated the cost of a last-dollar, first-dollar, and debt-free program. They assumed that the programs would be open to all students at two- and four-year public colleges and universities within each state, regardless of full-time or part-time status and not restricted by income (unless stated otherwise). CEW also calculated the cost of a first-dollar program that limits eligibility at four-year schools to families making less than $125,000 per year. The cost of a national free college program would likely be funded jointly by the federal government and the states (similar to how Medicaid is financed), although such a breakdown is not available.

In the year the program is implemented, a last-dollar program would cost the government $28 billion; by comparison, the first-dollar programs would cost about twice as much and a debt-free program would cost almost three times more. Those patterns largely hold over the long term, as a last-dollar program would cost $415 billion over an 11-year period — about half as much as a universal first-dollar program and about 40 percent less than an income-restricted first-dollar program.

The cost of free college varies by the type of program

| Type of Free College Program | First-Year Cost | Total 11-year Cost |

|---|---|---|

| Last-dollar tuition-free program | $28 billion | $415 billion |

| First-dollar tuition-free program capped at $125,000 eligibility | $50 billion | $683 billion |

| First-dollar tuition-free program | $58 billion | $800 billion |

| Debt-free program | $75 billion | NA |

SOURCE: Georgetown University Center on Education and the Workforce,The Dollars and Sense of Free College, 2020.

NOTE: CEW did not calculate an 11-year cost estimate for a debt-free program due to the complications of calculating how much students would need to finance their college education under that scenario.

Free College Programs Have Different Effects on Racial and Income Equity

The type and scope of free college programs have equity implications as well. For example, a last-dollar program would provide fewer benefits to lower-income students because such students generally receive more grant aid than other income groups — which means the government would have lower tuition costs to cover. However, because last-dollar programs require students to use their financial aid first before the government pays the remaining tuition cost, some students could still struggle to cover their remaining college costs like room and board. Universal first-dollar programs, by contrast, would distribute benefits almost evenly across income groups since the government covers tuition costs first before grant aid is applied; income-restricted first-dollar programs would provide the lowest amount of benefits to those in the top income quartile.

Those programs would have different effects across racial groups as well. For example, because white students disproportionately enroll in the most selective institutions, which generally have higher tuition costs, last-dollar programs would provide a disproportionate amount of benefits to those individuals. However, the CEW notes that the distributional estimates are only for the first year of such a program and would likely to change along with enrollment patterns. For example, free college programs could encourage more low-income students and students of color to enroll in selective and more expensive schools.

The benefits of free college programs vary across racial and income groups

Distribution of First-Year- Program Funding

| Income Quartile | Proportion of students at public colleges | First-Dollar Plan | Income-Restricted First-Dollar Plan | Last-Dollar Plan |

|---|---|---|---|---|

| Bottom quartile | 25% | 25% | 29% | 13% |

| Lower-middle quartile | 26% | 26% | 31% | 19% |

| Upper-middle quartile | 26% | 25% | 29% | 31% |

| Top quartile | 23% | 25% | 11% | 37% |

Race/Ethnicity

| White | 53% | 58% | 54% | 66% |

| Hispanic/LatinX | 21% | 17% | 19% | 13% |

| Black | 14% | 13% | 14% | 10% |

| Asian | 6% | 8% | 8% | 7% |

| More than one race | 4% | 4% | 4% | 3% |

| Other | 1% | 1% | 1% | <1% |

SOURCE: Georgetown University Center on Education and the Workforce,The Dollars and Sense of Free College, 2020.

NOTE: Other refers to American Indian, Alaskan Native, Native Hawaiian, or Other Pacific Islander.

Arguments For and Against a Free College Program

Those in favor of a nationwide free college program contend that it could have a number of economic and societal benefits. For example, the CEW report notes that a free college program could increase enrollment in undergraduate institutions by 4 to 8 percent over an 11-year period. That increased enrollment could lead to more individuals graduating from college, resulting in higher earnings and more employment opportunities — helping to boost the nation’s economic output and increase state and federal tax revenues. In fact, the CEW estimates that the annual increase in tax revenues associated with an income-restricted first-dollar plan would exceed the annual cost of such a program within the initial 10 years of the program’s implementation (CEW assumes graduation rates would remain at about their current levels). Increased educational attainment can yield a number of societal benefits as well such as lower crime rates, better overall health, and more civic engagement.

Alternatively, some analysts note that the economic benefits of free college programs are not guaranteed, vary by location, and that other options to increase educational attainment may be more efficient. For example, even though free college plans will likely increase postsecondary enrollment, some argue that the higher attendance may not necessarily translate to more students graduating. Likewise, other studies have indicated that enhancing the quality of a college education, such as by increasing spending for educational services, is more effective at increasing postsecondary attainment than reducing the student’s cost of attendance. In fact, the CEW notes that if the increased enrollment from a free college program is not supplemented with an expansion in student support services and reforms to developmental education, the cost of free college programs could actually rise — thwarting the goal of more college degrees. Finally, some analysts indicate that the results of free college tuition may vary by location — even when supplemental programs to help students complete coursework, meet deadlines, and find jobs are included.

Conclusion

While a number of free college programs already exist at the state and local level, there remain significant questions about the best design for such programs and their cost effectiveness. Implementing a nationwide program would also require a significant investment from the federal government and U.S. taxpayers. Depending on the type of program, certain groups may disproportionately benefit from such a program.

The United States faces a range of challenges to its future, including ensuring an educated and productive work force; however, the country also faces an unsustainable fiscal outlook stemming from a structural imbalance between spending and revenues. As the national conversation continues over how much the United States wants to invest in higher education, policymakers should recognize the costs, benefits, and distributional impacts of free college programs when considering such policies.

Related: 10 Key Facts About Student Debt in the United States

Image credit: Photo by Jon Lovette / Getty Images