You are here

Delaying Fiscal Reform is Costly, Annual Treasury Report Warns

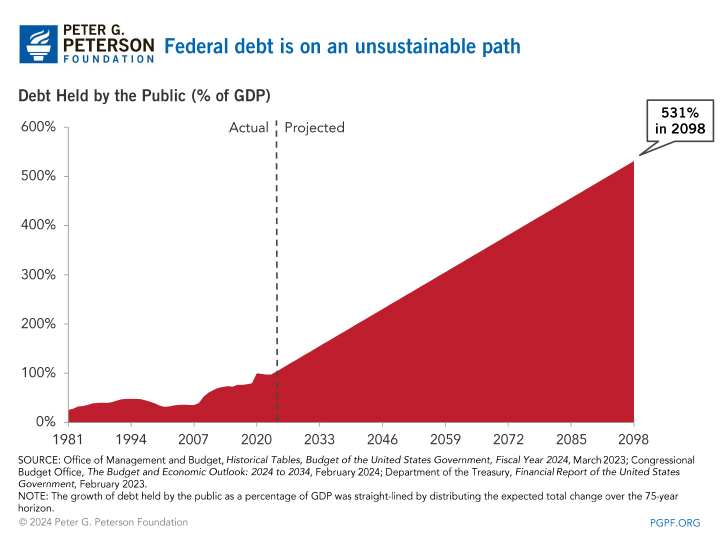

In the recent Financial Report of the United States Government for fiscal year 2023, the Department of the Treasury projects that debt as a percentage of GDP will grow to more than five times the size of the U.S. economy in the next 75 years. The report provides a comprehensive view of the federal government's finances and illuminates the nation’s long-term unsustainable fiscal outlook.

The two main findings related to the nation’s fiscal trajectory are:

- The United States’ debt-to-GDP ratio is projected to rise from 97 percent in 2023 to 531 percent in 2098.

- Delaying fiscal policy reform is costly – requiring a larger adjustment to government spending and revenues than if reform is enacted in 2024.

Why Is Our Current Fiscal Path Unsustainable?

The Department of the Treasury defines sustainable fiscal policy as “one where the ratio of debt held by the public to GDP (the debt-to-GDP ratio) is stable or declining over the long term.” The fiscal path of the U.S. government is currently unsustainable because the ratio of debt held by the public as a percent of GDP is expected to rise rapidly. The steady rise by 2098 will more than quintuple the debt-to-GDP ratio relative to its current level, which is already near its all-time high.

The Treasury’s report states that rising debt as a percentage of GDP is concerning because it indicates that the economy will have less capacity to support government programs. GDP is the value of final goods and services the country produces in a year, and when the debt-to-GDP ratio is larger, more of the economy goes towards servicing the debt and there is less margin to finance programs that encourage economic growth or provide a social safety net.

How Big Is the Fiscal Gap?

The mismatch between the government’s commitments and its revenues over a specified period is known as the fiscal gap. The fiscal gap can also be defined as how much noninterest spending and revenues must change over a period to reach a set debt-to-GDP ratio at the end of the period assessed.

Treasury’s report finds that the structural mismatch between government spending and revenues will contribute to increased deficits over the 75-year period ending in 2098.

Moreover, the longer we wait to act, the more difficult it will be to close the fiscal gap. If the United States begins fiscal reform in 2024, it will require some combination of spending cuts and increases in revenues that average 4.5 percent of GDP annually to reach fiscal sustainability. Waiting 20 years to address the trend of increasing debt as a percentage of GDP would require adjustments of 6.5 percent of GDP on average annually – nearly half again as high as the changes required by starting now. The Financial Report of the United States Government for fiscal year 2023 outlines the necessary adjustments to make the fiscal situation sustainable (also known as eliminating the fiscal gap) depending on the time for initiating reform:

| Reform Start Date | Necessary Adjustment (from Start Date to 2098) |

|---|---|

| Now (2024) | 4.5 percent of GDP ($1.3 trillion) |

| 2034 | 5.3 percent of GDP ($1.5 trillion in 2024 dollars) |

| 2044 | 6.5 percent of GDP ($1.8 trillion in 2024 dollars) |

The sooner reform occurs to eliminate the fiscal gap, the easier the task will be for policymakers and the lighter the burden will be on the next generation. Delaying reform simply allows even more debt to be accumulated and will require higher proportions of the budget allocated to interest payments. Such a trajectory could reduce private investment, economic opportunities, national security, and the safety net while also increasing the risk of financial crisis. Specifically, delaying reform places an additional burden on future generations — requiring higher future taxes to be paid and likely reducing spending on future benefits.

Conclusion

The Financial Report of the United States Government for fiscal year 2023 clearly demonstrates the nation’s unsustainable fiscal outlook in the long run and the cost of delaying reform. Acting now to address the mismatch between spending and revenues — and control the growth of debt as a percentage of GDP — is advantageous to minimize the cost of necessary adjustments and establish a positive fiscal future for the United States.