You are here

How Much Funding do State and Local Governments Receive from the Federal Government?

Each year, the federal government provides significant funding to state and local governments. Those funds are used to maintain programs and services such as healthcare, income security, education, and infrastructure. Over the last four decades, federal grants to state and local governments have made up about 17 percent of their total revenues. Here, we look at why the federal government provides funding to state and local governments and how that funding has changed over time.

Why Does the Federal Government Give Grants to State and Local Governments?

The federal government provides funding for a variety of programs, services, and projects that may be better administered at lower levels of government by officials who are more familiar with unique local needs. For example, Title I education grants provide funding to local education agencies to help ensure that children from low-income families are able to meet state education standards. Local officials can then allocate those funds for programs that are tailored to local needs, such as extra instruction for reading or establishing after-school and summer programs.

Grants are also made to promote national priorities that the federal government does not have the authority to pursue itself. For example, the Bipartisan Infrastructure Law established the Safe Streets and Roads for All (SS4A) program in 2021 with $5 billion in appropriated funds over five years. SS4A provides funding for regional and local infrastructure projects that align with the Department of Transportation’s National Roadway Safety Strategy. The strategy aims to eliminate roadway fatalities over the long term by improving the country’s highways, roads, and streets. Because many roadways are maintained by regional and local authorities, the federal government incentivizes them to complete infrastructure projects that are aligned with the strategy.

The Focus of Federal Funding Has Changed Over Time

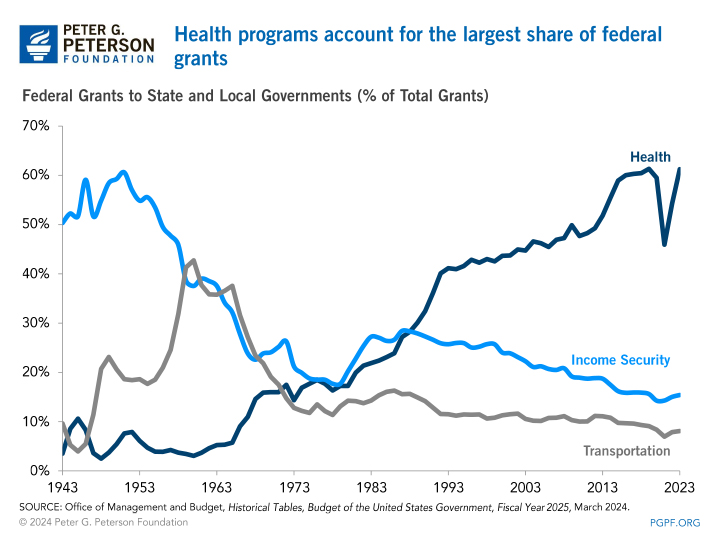

Historically, the largest share of federal support to states has been for income security and transportation. From roughly 1940 to 1970, the largest federal grant programs were for family support payments and highways. Since 1989, grants related to health have taken up the largest share, with payments to states for Medicaid being the largest program.

Federal grants to state and local governments totaled $1.1 trillion, or 18 percent of all federal outlays, in 2023. Medicaid accounted for the largest portion, with the federal government paying out $616 billion.

In 2023, the largest federal grant programs to state and local governments were for Medicaid and Income Security

| Federal Grants to State and Local Governments by Program | Outlays in 2023 (Billions) |

|---|---|

| Medicaid | $616 |

| Income Security | $167 |

| Education | $48 |

| Highways | $48 |

| Disaster Relief | $24 |

SOURCE: Office of Management and Budget, Historical Tables, Budget of the United States Government, Fiscal Year 2025,, March 2024.

NOTE: Not all grant programs are included. “Income Security” includes the Supplemental Nutrition Program, rental assistance, payments to support children, and other similar programs.

© 2024 Peter G. Peterson Foundation

Federal Grants to State and Local Governments Have Increased

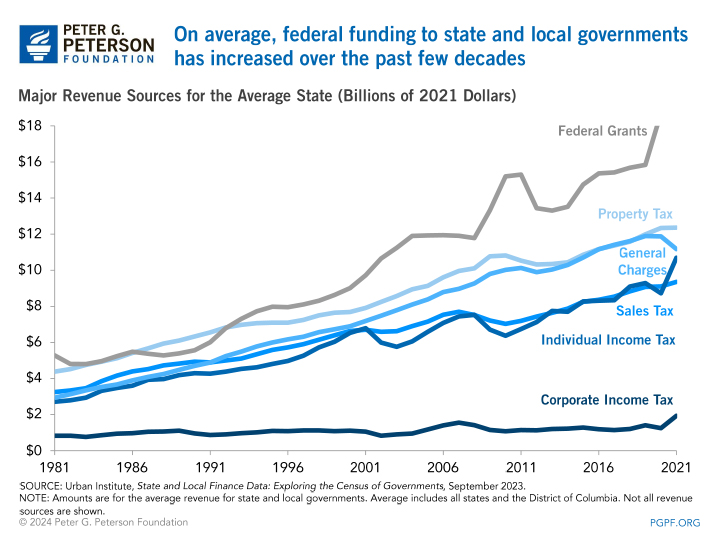

The share of total revenues that come from federal grants has steadily increased over the last three decades according to data compiled by the Urban Institute. In 1981, federal grants accounted for $5.3 billion, or 18 percent, of the average state’s revenues when adjusted for inflation. Grants jumped to $18.7 billion in 2020 due to spending related to the pandemic; federal grants to the average state increased to $22.0 billion, or 20 percent, of the average state’s total revenues in 2021. Federal grants to state and local governments also increased as a share of total federal outlays over the same period, from 14 percent in 1981 to 18 percent in 2021.

What Caused Federal Grants to State and Local Governments to Increase?

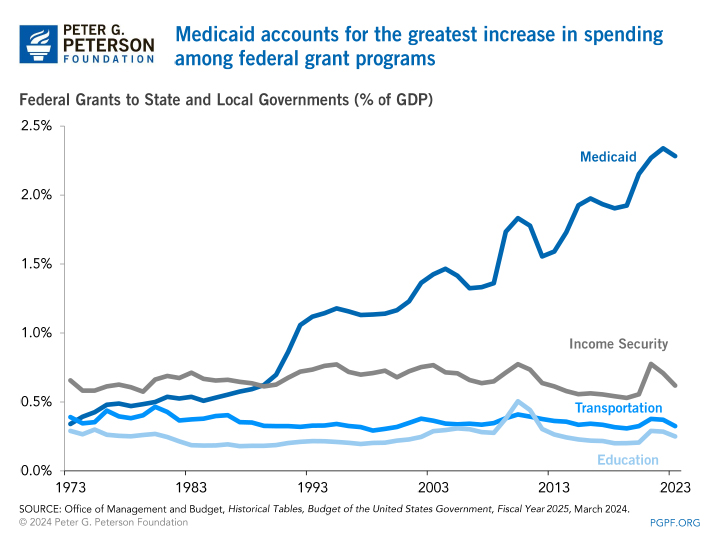

For the past several years, most growth in federal grants to state and local governments has been from Medicaid. From 2013 to 2023, grants for Medicaid increased from 1.6 percent of gross domestic product (GDP) to 2.3 percent as the federal government funds most of Medicaid. In 2024, the federal government will pay between 50.0 and 77.3 percent of total program spending in each state.

Increasing Medicaid spending is attributable to the expansion of program eligibility under the Affordable Care Act and the rising cost of healthcare in relation to other commodities. Additionally, in response to the COVID-19 pandemic, lawmakers enacted enhanced Medicaid funding to keep people enrolled in the program through the public health emergency. That emergency declaration ended in April 2023, and the enhanced funding will be phased out by the end of that year.

Grants to state and local governments for income security programs also increased sharply in response to the pandemic. Spending for the Emergency Rental Assistance Program accounted for one of the largest increases in that budget category. Over the course of the pandemic, support for the program totaled $46 billion. Other significant increases have been for grants for child nutrition programs and payments to states for child care and development block grants. Pandemic-related grants were temporary in nature and as programs have expired, grants for income security declined in 2023.

Conclusion

States rely on the federal government for a significant portion of their total annual revenues, which are typically used for healthcare, income security, education, and infrastructure. Without that federal assistance, states would likely be unable to deliver the same level of programs that provide access to healthcare, support children and families, and promote economic activity. At the same time, spending on grants to states for Medicaid has increased significantly, reflecting Medicaid’s expansion and rising healthcare costs. Given that funding to state and local governments totals nearly one-fifth of all federal spending, it is critical to examine that fiscal relationship in context with the United States’ fiscal challenges in order to better understand the drivers of the national debt and seek ways to improve the structural imbalance between spending and revenues.

Related: What is the National Debt Costing Us?

Image credit: Photo by Justin-Sullivan/Getty Images