You are here

Housing Insecurity: What is the Federal Government Doing to Prevent Evictions during the Pandemic?

Housing insecurity is an ongoing issue for millions of American families. COVID-19 and its economic impact exacerbated an existing shortage of affordable housing that far predated the pandemic. Now, with the recent expiration of an eviction moratorium, many families are facing particularly challenging circumstances when it comes to their housing costs and are at risk of experiencing homelessness. Here’s an overview of the state of play for housing affordability in the United States as well as how rising housing costs place increasing burdens on families, existing housing programs, and new federal efforts to address housing insecurity during the pandemic.

What Does The Federal Government Spend On Housing Support Programs?

Housing support is a small but significant part of the federal budget. In 2019, the last year before the pandemic, the federal government spent $139 billion on housing programs, or 3 percent of all federal spending that year.

In response to the pandemic, the Coronavirus, Aid, Relief, and Economic Security (CARES) Act, enacted in March 2020, increased funding for existing housing programs under the Department of Housing and Urban Development (HUD) by $12 billion.

Subsequent legislation made available an additional $57 billion in pandemic relief for renters and homeowners through state and local initiatives, though many programs have not yet disbursed funds to households in need. The majority of this additional pandemic relief would provide renters with up to 18 months of assistance, while the rest is intended to help prevent mortgage delinquencies, defaults, foreclosures, and loss of utilities.

How Many Americans Are In Need Of Housing Support?

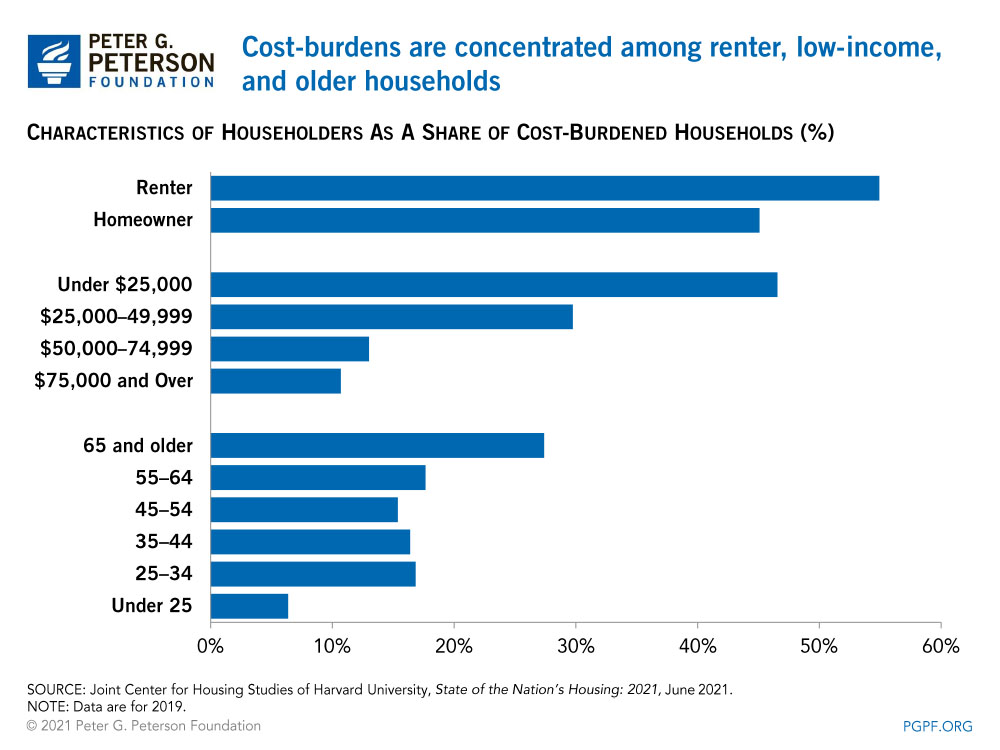

HUD considers households with rent or mortgage costs exceeding 30 percent of household income to be cost-burdened. In 2019, about 37 million households or 1 in 5 homeowners and nearly half of renters were cost-burdened, reflecting a decline of 3 percent from the 38 million households in the previous year according to a report by the Joint Center for Housing Studies of Harvard University. Households with incomes below $25,000 accounted for 46 percent of cost-burdened households. Older Americans (age 65 and older) were more likely to be cost-burdened, accounting for about a quarter of such households. Moreover, non-white households accounted for 43 percent of cost-burdened households despite only making up 32 percent of total households, which reflects in part a history of housing discrimination experienced by people of color.

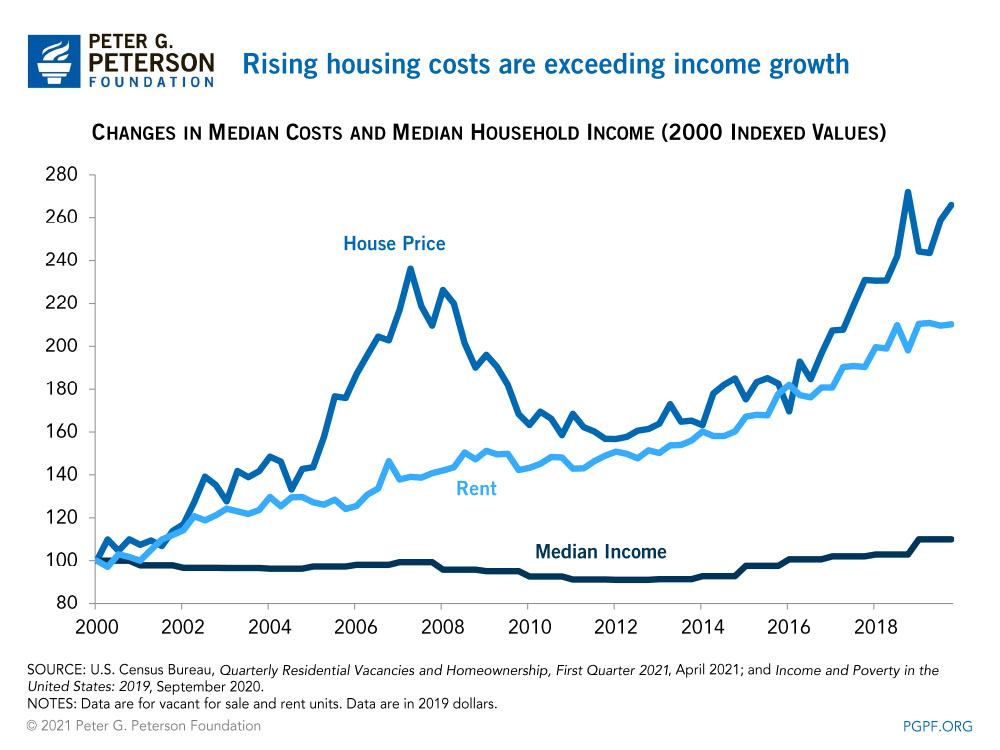

Unaffordable housing is attributable to a growth in costs that has outpaced the growth in household incomes. As a result, cost-burdened households can struggle to pay for core needs. For example, in 2019, a cost-burdened two-earner, one-child, renter household (where both earners worked full-time, making the federal minimum wage) would have had about $348 a week in pretax dollars after rent to cover childcare, nutrition, transportation, healthcare, and other essentials. Yet, despite the need, only 1 in 5 cost-burdened households receive housing assistance, according to the Urban Institute.

Growing housing costs are a function of low supply and high demand. The shortage of housing primarily stems from local regulations that restrict the amount of land available for development by imposing minimum lot size requirements and other restrictions. At the same time, low-interest rates, which make the cost of borrowing more affordable, have led to an increase in the demand for homes, and pushed the costs of buying even higher. As home prices have made ownership inaccessible to many Americans, more have resorted to renting, which in turn has led to higher rents.

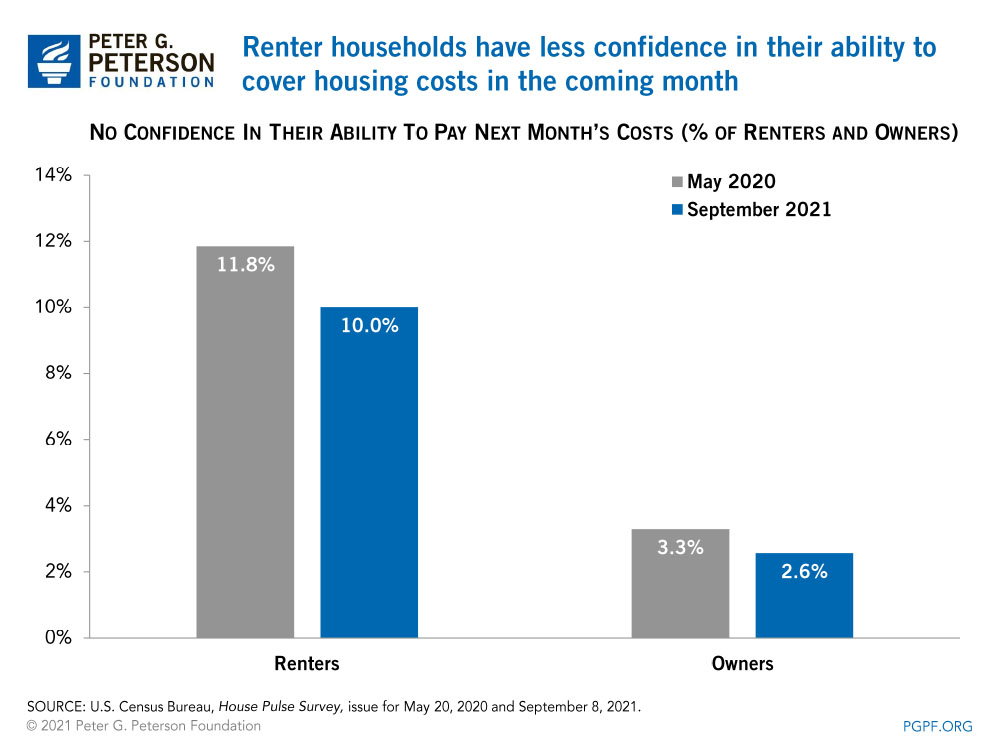

Cost burdens have persisted throughout the pandemic, in particular for renter households. For example, renter households continue to exhibit a lower confidence in their ability to pay next month’s costs and are more likely to be behind on monthly payments, according to the Census Bureau. Such households can result in increased federal spending as cost-burdened renters have higher eviction rates, increased financial fragility, and wider use of social safety net programs relative to other households, according to the Pew Charitable Trusts. As a recent example, when millions lost work due to the pandemic and housing costs began to strain family incomes, many households turned to social programs for financial support, leading to a significant increase in federal spending for unemployment insurance and the Supplemental Nutrition Assistance Program.

Pre-Pandemic Federal Housing Support

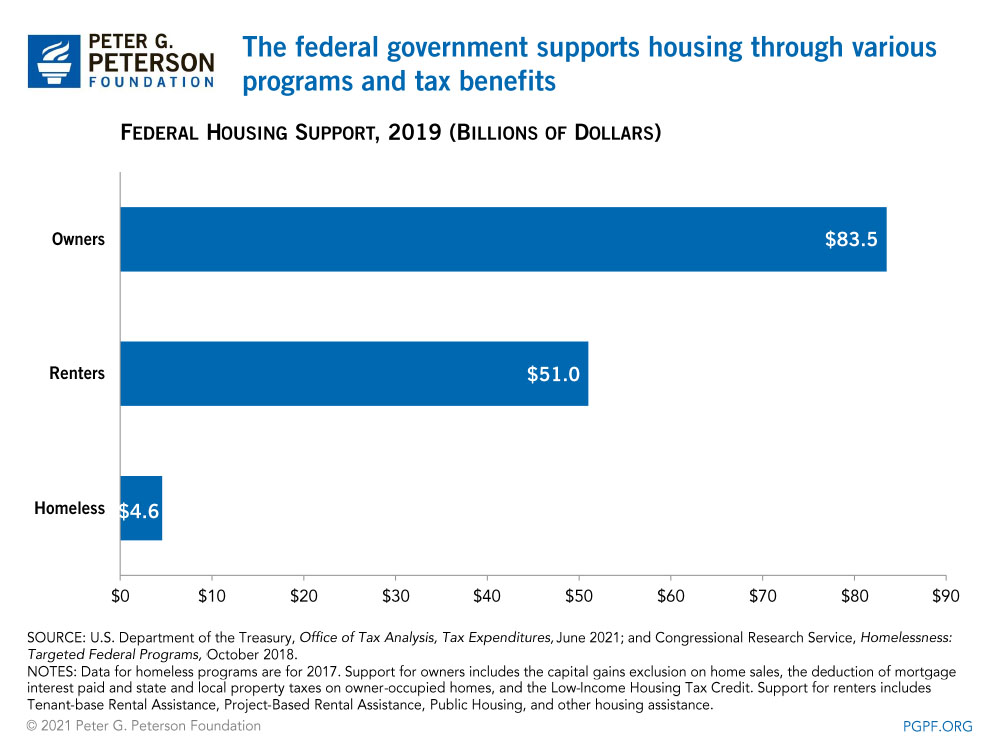

In a typical year, the federal government promotes affordable housing through tax expenditures (preferences in the tax code) that largely benefit homeowners and other programs aimed at low-income renters. By supporting homeowners, the federal government enables families to build wealth through home equity, which owners can later leverage to consolidate other debts or plan for retirement. By supporting renters through affordable and stable housing, the federal government reduces homelessness and can bolster the educational outcomes of children and the employment opportunities of adults. In 2019, the federal government spent about $84 billion in tax expenditures for owners and developers and $56 billion in spending targeted toward renters.

Tax Expenditures Reduce the Cost of Homeownership

Homeowners benefit from a range of tax expenditures that reduce their federal tax liability and, therefore, the cost of owning a house. For example, homeowners may reduce their taxable income by deducting property taxes and some interest paid on mortgage debt when they itemize deductions in their federal tax forms. Such expenditures reduced federal revenues by $75 billion in 2019. While tax expenditures mainly benefit wealthier households, such spending has halved since the enactment of the Tax Cuts and Jobs Act, which placed a limit on the deduction of state and local taxes. In 2026, when that provision has expired, the Department of Treasury estimates that those expenditures will reduce federal revenues by $155 billion.

Improving Accessibility to Home Financing Options

The federal government supports potential borrowers through various financing programs. Those programs are treated on a credit reform basis (the present value of future costs are recorded in the budget). Federal financing options produced, on net, a receipt of $26 billion in 2019 stemming from fees, insurance premiums, and the sale of foreclosed properties.

- The Federal Housing Administration (FHA) fully insures private loans against the possibility of low-income borrowers defaulting through the Mutual Mortgage Insurance program (the largest program under FHA). To qualify, borrowers must meet specific criteria, including making a down payment of 3.5 percent and having mortgages that do not exceed a statutory maximum depending on the area. FHA-insured mortgages issued in 2019 produced an estimated budgetary savings of $24.6 billion.

- The Department of Veterans Affairs (VA) offers veterans and their spouses loan guarantees to purchase, construct, and refinance homes. The VA guarantees a portion of mortgage loans (typically around 25 percent) and requires borrowers to pay up-front fees depending on the size of the loan the specifics of their service. VA-guaranteed loans issued in 2019 generated an estimated $3.1 billion budgetary savings.

- The Department of Agriculture (USDA) administers various rural housing programs, which support some renters, make low-interest direct loans, and guarantee private loans to very low- and moderate-income rural residents to purchase or repair homes. The program also offers loans and grants specifically for Americans age 62 and older with incomes below 50 percent of the area’s median income. The cost of USDA-administered grants, loans, and guarantees totaled $1.8 billion in 2019.

Construction, Rent Assistance, and Support for People Experiencing Homelessness

The federal government incentivizes the construction of housing and provides rental assistance through various programs. For example, the Low-Income Housing Tax Credit subsidizes the rehabilitation and construction of housing for low- to moderate-income renters. To qualify, owners or developers must meet thresholds that ensure diversity in the incomes of their tenants; in 2019, the credit reduced revenues by about $9 billion.

The federal government supports low-income individuals through three main subsidy programs that address the cost of renting based on income. Public Housing Authorities and HUD administer such programs, which cost $51 billion in 2019. In addition, through various targeted federal and VA programs, the federal government spent about $5 billion assisting people experiencing homelessness by providing housing, services, and other support.

Federal Housing Support During the Pandemic

Lawmakers enacted significant new legislation to support housing during the pandemic. Initial pandemic relief stemmed from provisions of the CARES Act, which increased funding for existing HUD programs that provide housing for the elderly, housing vouchers, and direct rent assistance. Other provisions included a moratorium on evictions and forbearance options for federally backed mortgages, though many private lenders followed the government’s lead.

The CARES Act moratorium initially expired in July 2020, but was extended several times by the Centers for Disease Control and Prevention (CDC); the last extension was through July 2021. Separately, certain borrowers were provided with up to three additional months of forbearance. While federal moratoria and forbearance options have helped households avoid eviction, it did not prevent families from accruing housing-related debt.

Even as the economy shows signs of improvement, nearly 6 million renter households owe an estimated $15 billion in back rent, according to National Equity Atlas. Consequently, property owners who rely on rental income to support their families have also faced deep financial distress due to the pandemic. Moreover, about 20 percent of owner households that signed up for forbearance, or about 2 million, remained in such programs at the end of June 2021. To meet those needs, the federal government established the Emergency Rental Assistance program and Homeowner Assistance fund, which provide financial resources through existing state programs.

Emergency Rental Assistance Program (ERA): $47 Billion

The ERA program provides funding to assist households that are unable to pay rent or utilities for up to 18 months in some cases. Eligible households include those with individuals that qualified for unemployment benefits, can demonstrate a risk of experiencing housing instability, and that have a household income below 80 percent of the area median income. The Consolidated Appropriations Act, enacted in December 2020, established the program with an initial $25 billion in funding. By February 2021, the Treasury Department had disbursed all those funds to state, territories, localities, and tribes. The American Rescue Plan (ARP), enacted on March 2021, provided an additional $22 billion funded through the Coronavirus Relief Fund. ERA funds were allocated as follows:

- $42.5 billion to state governments, including the District of Columbia, based on their populations in July 2020.

- $2.5 billion for high-need communities. Funds were allocated based on the number of low-income households paying more than 50 percent of income on rent, rental market conditions, and employment trends.

- The remainder for tribal entities, territories, and administrative costs.

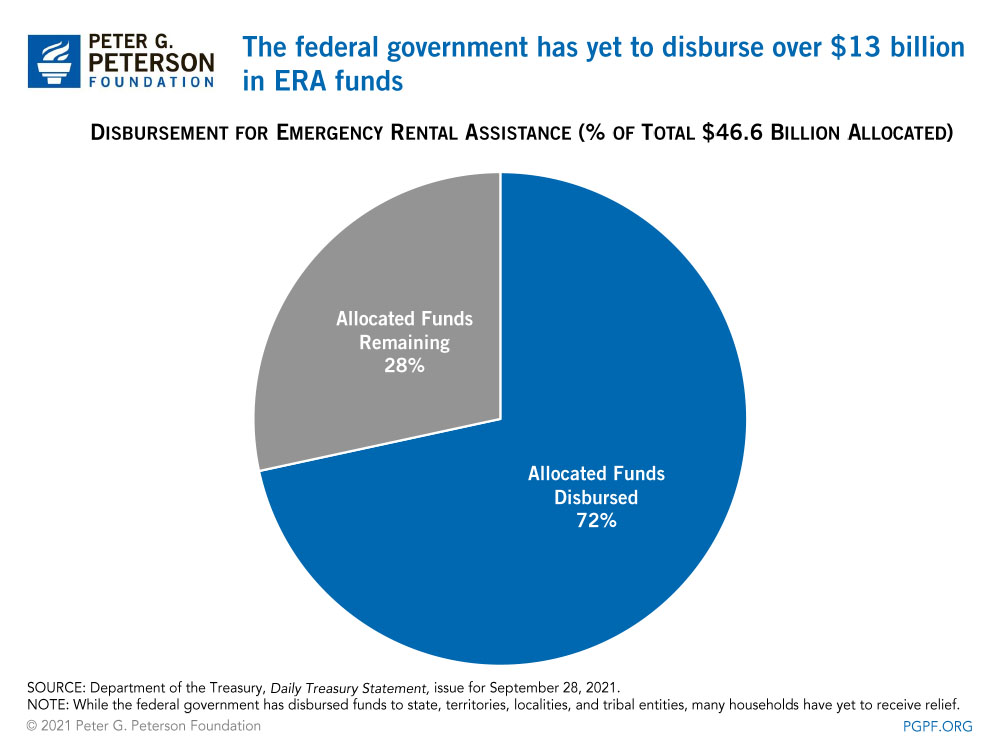

As of September 28, 2021, the Department of the Treasury has disbursed about $33.4 billion of the $46.6 billion allocated for the program to participating governments, though many households have yet to receive relief. Treasury data from August (the most recent available) shows that rental assistance programs have spent just $7.7 billion of total funds available, which has helped about 1.4 million households.

Homeowner Assistance Fund (HAF): $10 Billion

The ARP established the nearly $10 billion HAF to help homeowners pay for mortgage payments, homeowner’s insurance, utilities, and other specified purposes. Eligible homeowners include those who experienced a financial hardship after January 21, 2020, have incomes at or below 150 percent of area median income, and are seeking assistance for their primary residence. Of the total funds, over $9 billion was allocated to state governments, Puerto Rico, and the District of Columbia. The remaining funds were allocated among the Department of Hawaiian Homelands, tribal entities, territories, and to cover administrative costs. Complete disbursement data is not yet available as participating governments continue to develop their programs.

Other ARP Relief

The ARP targeted other funds to address acute housing insecurity and related costs. For example, the legislation directed $5 billion for emergency housing vouchers for individuals and families at the risk of or experiencing homelessness. ARP also earmarked $5 billion for the HOME Investment Partnerships program to provide housing and services for people experiencing homelessness. Another $5 billion was targeted for utility assistance.

Promoting Prosperity

The federal government supports renters and homeowners through various programs and tax expenditures, which represent a small but important part of the federal budget. Despite such programs and funding, affordable housing remains out of reach for many families. Persistent growth in housing costs will add stress to an already unsustainable federal budget if more households require the use of social safety net programs. As the nation continues to emerge from the pandemic, lawmakers will need to make strategic, forward-looking decisions to address the complex factors driving a shortage of affordable housing.

Related: How Does the Federal Government Support Housing for Low-Income Households?

Image credit: Scott Heins/Getty Images/iStockphoto