You are here

What the Fitch Downgrade Says about our Fiscal Challenges

Fitch Ratings recently downgraded the U.S. long-term credit rating from its top mark of AAA to AA+, marking the second time in history that a major credit-rating agency downgraded the United States. The first time was by Standard & Poor’s (S&P) in 2011.

Fitch cited multiple reasons for the decision, including:

- The nation’s high and rising national debt

- The lack of a plan to address the major drivers of the debt

- The erosion of good governance

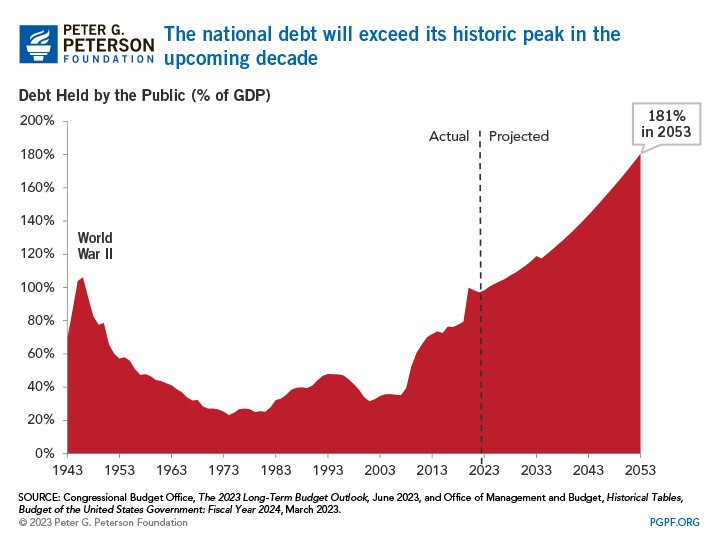

The level and trajectory of federal debt is a central reason for Fitch’s downgrade. At nearly 100 percent of gross domestic product (GDP), the U.S. debt-to-GDP ratio is significantly higher than that of most other AAA-rated countries. According to projections from the Congressional Budget Office, the nation’s debt will soon exceed its all-time high relative to GDP and skyrocket to 181 percent in 2053.

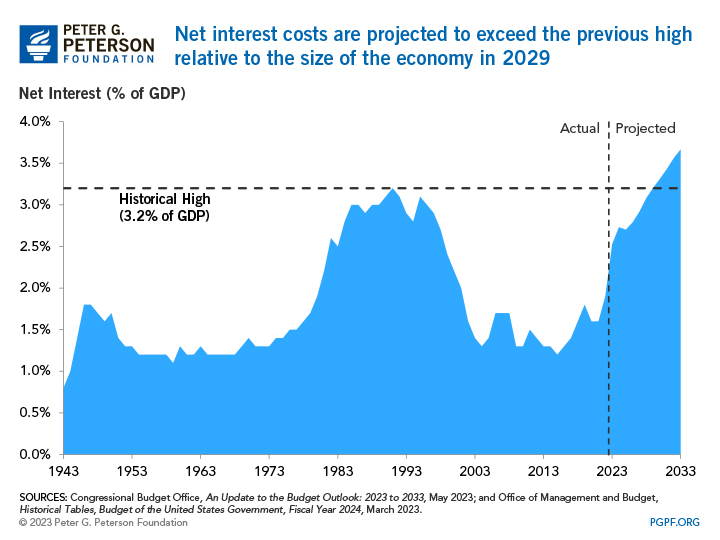

Fitch also points to the lack of a framework to address the primary drivers of that debt. The nation’s high and rising debt is primarily due to a structural mismatch between federal spending and revenues. The aging of the nation’s population, coupled with rising healthcare costs, is causing spending on mandatory programs such as Social Security and Medicare to rise substantially. Federal spending on Medicare is projected to increase from 3.1 percent of GDP in 2023 to 5.5 percent by 2053; meanwhile Social Security outlays will rise from 5.1 percent of GDP to 6.2 percent over that same period. Furthermore, as the level of public debt rises, and interest rates remain relatively high, the cost of servicing that debt will rise as well. Interest costs as a percentage of GDP will exceed the previous high of 3.2 percent (which occurred in 1991) before the end of the decade. What’s more, the nation’s tax system will not generate enough revenues to cover spending in those and other areas.

Finally, Fitch found that a “deterioration in standards of governance” negatively impacted U.S. credibility, particularly surrounding fiscal and debt matters. The agency’s decision comes just two months after the United States narrowly avoided defaulting on its debt, and reflects a view that the nation’s political divides are, too often, an impediment to consensus policymaking.

Although Fitch raised concerns in their downgrade, they also noted that the United States has a “large, advanced, well-diversified and high-income economy, supported by a dynamic business environment,” and “the U.S. dollar is the world's preeminent reserve currency, which gives the government extraordinary financing flexibility.”

Fitch’s downgrade of U.S. debt draws attention to our underlying issues of fiscal sustainability. The national debt is high and will continue to grow unless policymakers overcome entrenched political divisions to find common ground on closing the structural gap between spending and revenue. Fortunately, there are solutions available to improve the fiscal trajectory of the country – the nation just needs leadership.

Related: What Is the National Debt Costing Us?

Image credit: Photo by Samuel Corum/Getty Images