You are here

President's Budget Again Relies on Optimistic Economic Projections and Unlikely Spending Cuts

President Trump has released his fourth budget, outlining the administration’s policy proposals and budgetary projections for the next decade. Following the pattern of previous years, this budget largely relies on very optimistic projections of economic growth and unlikely budget cuts to reduce the deficit.

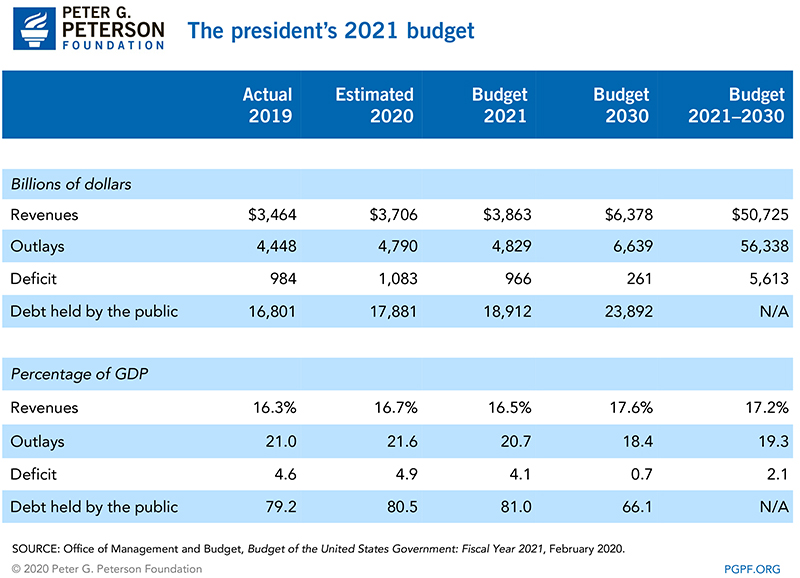

According to the administration’s calculations, under the president’s fiscal year 2021 budget:

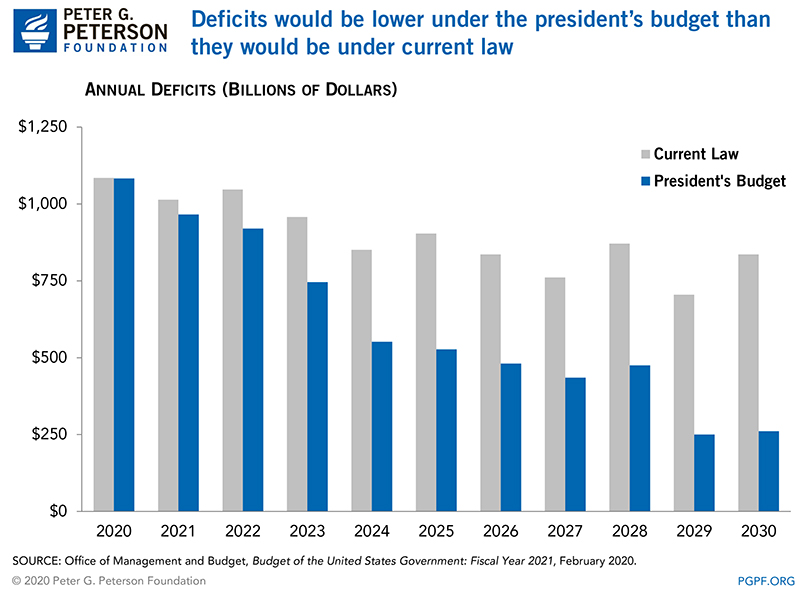

- Budget deficits would be reduced from $1.1 trillion in 2020 to $260 billion in 2030.

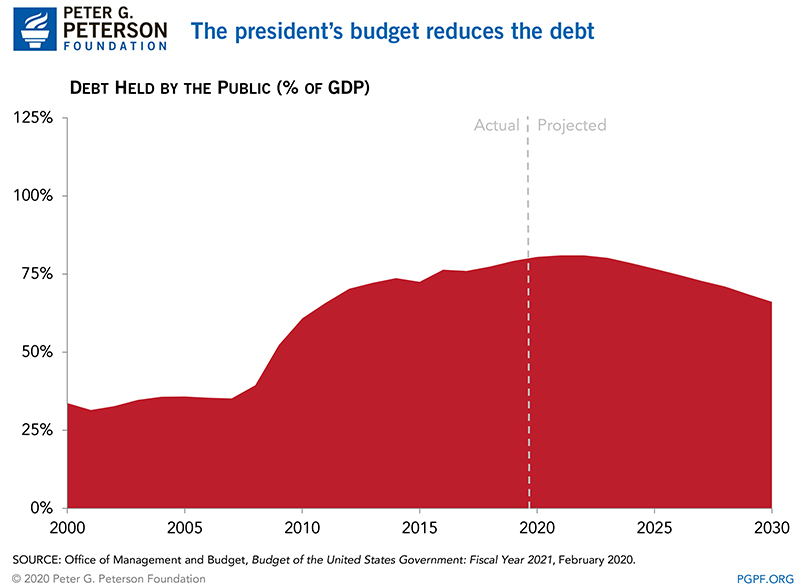

- Debt held by the public would be reduced from 80.5 percent of gross domestic product (GDP) in 2020 to 66.1 percent at the end of 2030.

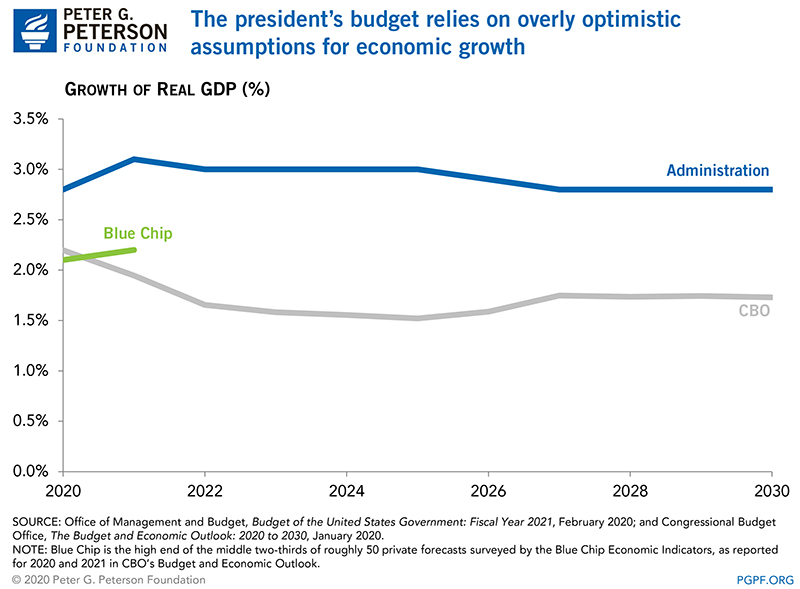

- Economic growth would average 2.9 percent over the 10-year period. By 2030, the administration estimates that GDP would be $37 trillion — $4 trillion (13 percent) higher than projected by the Congressional Budget Office.

- Revenues would average 17.2 percent of GDP and spending would average 19.3 percent over the 10-year budget window. By comparison, the 50-year historical average for those figures are 17.4 and 20.4 percent of GDP, respectively.

- More than $1.5 trillion in savings would be achieved through reductions in non-defense appropriations.

- Further savings would come from mandatory programs, including reforms to the Children’s Health Insurance Program, Medicare, and Medicaid.

Debt and Deficits Would Be Reduced

Under the administration’s calculations, the budget would reduce the deficit from $1.1 trillion (or 4.9 percent of GDP) in 2020 to $260 billion (or 0.7 percent of GDP) in 2030.

Debt as a percentage of GDP would decrease from 81 percent at the end of 2020 to 66 percent at the end of 2030.

The Administration’s Economic Assumptions are Overly Optimistic

Underlying this budget is an assumption that real (inflation-adjusted) GDP will average 2.9 percent growth annually over the next 10 years. Such projected growth is substantially higher than the forecasts by other organizations, including the Congressional Budget Office and the Blue Chip survey of private forecasters.

The President’s Budget Focuses on Reducing Spending

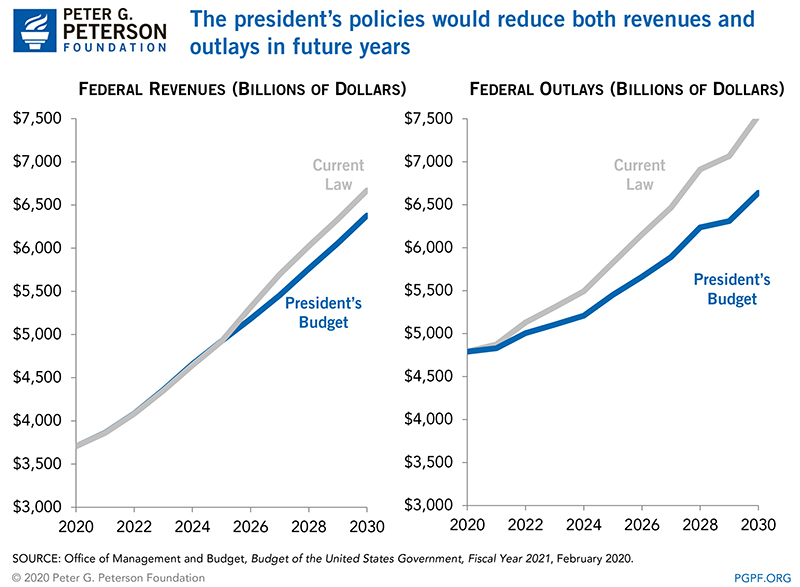

The president’s budget anticipates that revenues will grow from $3.7 trillion in 2020 to $6.3 trillion in 2030, approximately $291 billion lower than what is projected under current law. The only major revenue proposal is the extension of the individual income, estate, and gift tax provisions from the Tax Cuts and Jobs Act, which are scheduled to expire in 2025. Extending those provisions would decrease the amount of revenues that would be collected between 2025 and 2030 by $1.4 trillion. Other policies in the president’s budget would increase revenues by $199 billion over the next 10 years.

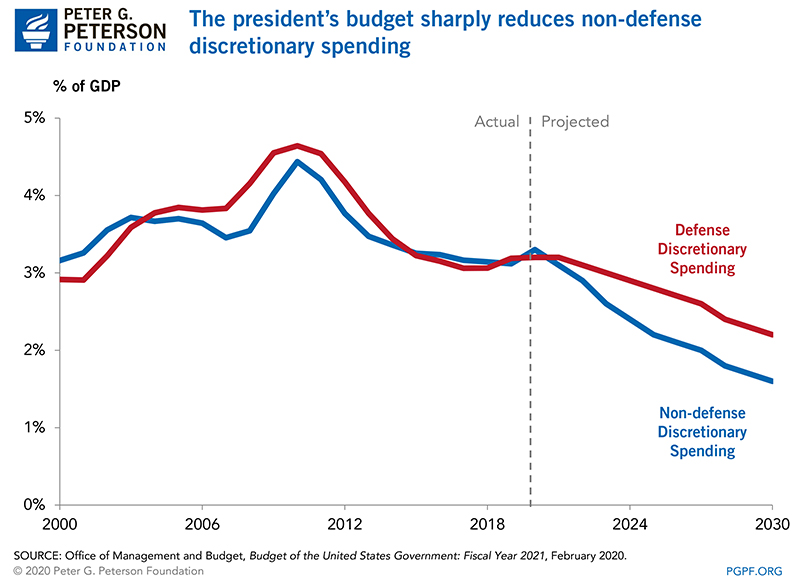

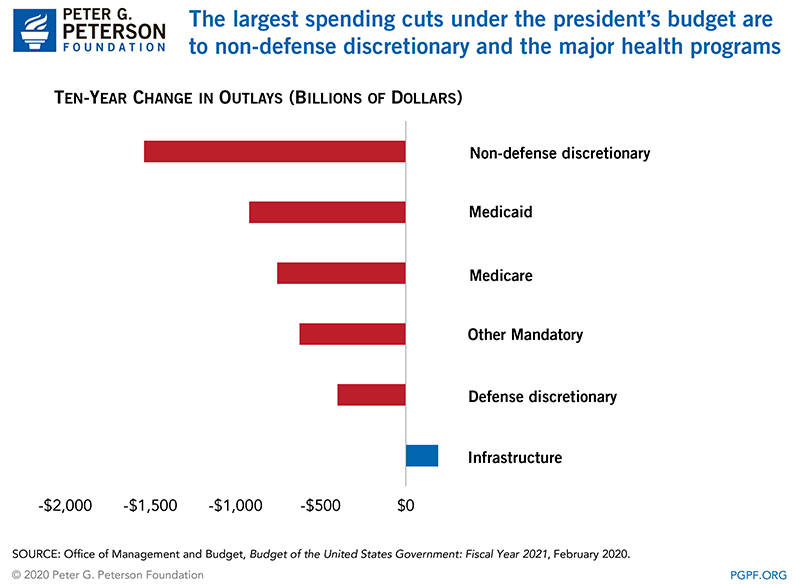

Spending under the president’s budget is projected to be $4 trillion less than under the current-law baseline used by the administration. Over the 10-year period, non-defense discretionary spending would be cut by 19 percent, while defense discretionary spending would be reduced by 5 percent. Spending on mandatory programs would also be reduced by 5 percent.

Discretionary Spending Would Decline

Under the president’s budget, non-defense discretionary spending would be reduced by more than $1.5 trillion — or 19 percent — over the next 10 years. While non-defense discretionary spending only makes up 15 percent of total spending, activities under this category of spending include scientific and medical research, education, infrastructure, national parks, law enforcement, grants to state and local governments, and pay for federal workers.

While the budget outlines spending priorities through 2030, more detail on proposed appropriations is provided for Fiscal Year 2021. The areas with the largest funding reductions for that year would be from the following departments:

- Housing and Urban Development ($8.6 billion cut, or 15.2 percent): the largest changes would result from elimination of the Community Development Block Grant and reductions to rental assistance programs.

- Department of State ($11.7 billion cut, or 22 percent): changes include consolidating U.S. Agency for International Development programs.

- Health and Human Services ($9.5 billion cut, or 9 percent): the budget includes the elimination of the Community Services Block Grant and Low Income Home Energy Assistance Program.

- Commerce ($7.3 billion cut, or 48 percent): the budget requests the elimination of the Economic Development Administration, among other changes.

Reductions in Mandatory Programs would be Focused on Healthcare, Education, and Nutrition Assistance

The president’s budget would reduce mandatory spending by a total of $2.1 trillion between 2021 and 2030 compared with projections under current law. Much of the reductions would derive from spending characterized as waste, fraud, and abuse in the Medicaid and Medicare programs, which is difficult to ascertain. Significant cutbacks related to a future healthcare reform proposal, welfare, and education have also been proposed.

Proposed 10-year reductions in mandatory spending include:

- Health Reform ($844 billion cut): The budget includes a placeholder for a future health reform plan. Details for the plan have yet to be released.

- Medicare ($756 billion cut): Eliminate wasteful spending and address fraud and abuse.

- Welfare Reform ($292 billion cut): Reform Supplemental Nutrition Assistance Program, reduce Temporary Assistance to Needy Families, require a Social Security number for Earned Income Tax Credit and Child Tax Credit recipients.

- Medicaid ($920 billion cut): Strengthen work requirements and address fraud and abuse.

- Education ($124 billion cut): Eliminate Public Service Loan Forgiveness and create a single income-driven student loan repayment plan.

Action Is Urgently Needed on Our Nation’s Long-Term Fiscal Challenges

Although deficits and the debt-to-GDP ratio would decline under the president’s budget, these estimates are based on very optimistic growth projections and significant cuts that are not likely to be achieved to areas of the budget that are not driving our fiscal imbalance.

Reducing the deficit and debt are commendable goals. The administration and Congress should work together to establish a budget framework that focuses on addressing the key drivers of the debt — rising healthcare costs, America’s aging population, and rapidly escalating interest costs — and uses consensus estimates of economic growth. A realistic and comprehensive fiscal reform plan would give the country a stable fiscal foundation that will support economic growth and better prepare our nation for the future.