America’s small businesses have been severely impacted by the economic downturn caused by the pandemic — and lawmakers have focused a significant part of federal relief on helping this critical part of our economy.

As of March 2021, six pieces of legislation have been enacted to help the United States cope with the economic impact of COVID-19. Taken together, those COVID relief bills will cost a total of $5.3 trillion — $968 billion of which has been targeted to small businesses, though total available funding for various loan programs exceeds the net cost associated with the program, as businesses are expected to repay a portion of their loans. Lending from the Federal Reserve provided a small amount of additional support, but the lending program that most directly impacted small businesses expired on January 8, 2021. Below is a review of the elements of assistance for small businesses.

Paycheck Protection Program ($823 Billion, Net Cost)

The Paycheck Protection Program (PPP) was enacted by the Coronavirus Aid, Relief, and Economic Security (CARES) Act in March 2020 and was most recently extended in March of this year. The terms of the program have evolved since it was first created, but it provides federally backed loans to incentivize small businesses to maintain their payroll during the crisis; those loans would be forgiven if used for certain expenses and if employment and compensation levels are maintained.

Who Is Eligible?

Nonprofits, self-employed individuals, independent contractors, and small businesses that were impacted by the pandemic may apply for loans through the end of May. If businesses were forced to shut down, they remain eligible for a smaller loan than businesses that continue to operate.

How Is the Loan Calculated?

Most businesses are eligible to borrow 250 percent of their average monthly payroll expenses, up to a total of $10 million. From January–May 2021, businesses that previously received PPP loans may apply for a second draw loan of up to $2 million, and borrowers in the accommodation and food services sector are eligible for loans of up to 350 percent of their monthly payroll expenses, up to $2 million. The portion of the loan used for payroll expenses, interest payments, rent, and utilities will be forgiven.

How Is the Loan Administered?

The PPP portion of the CARES Act made significant changes to an existing Small Business Administration (SBA) loan program. The PPP is largely administered through private banks and credit unions previously approved by the SBA, but other lenders have also been enrolled.

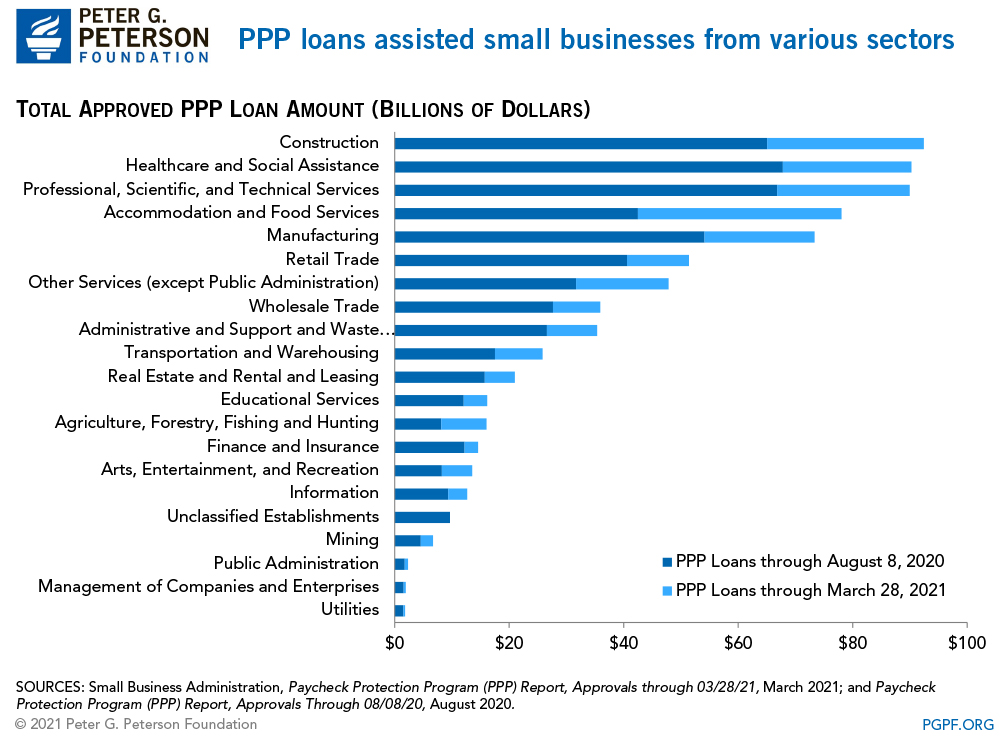

As of March 28, 8.7 million PPP loans had been issued, totaling $734 billion, and with an average loan size of about $84,000. Those loans were made to various sectors, with businesses in construction; healthcare; and professional, scientific, and technical services among those receiving the most funds.

Research suggests that design issues with the program may have limited its reach and effectiveness, especially for businesses that were most affected by the COVID-19 pandemic. Nevertheless, the PPP has helped millions of businesses stay afloat during the pandemic. The latest COVID-19 legislation, as well as executive actions taken by the Biden Administration, further increased access to the program by expanding eligibility and removing certain restrictions.

Economic Injury Disaster Loans and Emergency Economic Injury Advance Grants ($545 Billion, Total Available for Loans and Grants)

The Economic Injury Disaster Loans (EIDL) are small, lower interest loans with options for principal and interest deferment. Small businesses that apply for such loans were also eligible for Emergency Economic Injury Advance Grants, which were advances of up to $10,000 that do not need to be repaid. While those initial grants have been fully disbursed as of July 2020, businesses in low-income communities that previously received or applied for EIDL Advance Grants are eligible for an additional $10,000 through Targeted EIDL Advance Grants. Those loans and grants can be used for operating expenses such as payroll costs, pay for sick leave, and debt-service costs.

Restaurant Revitalization Fund ($29 Billion, Net Cost)

Restaurants and other qualifying food businesses that own or operate 20 or fewer establishments may be eligible for a grant for up to $10 million in pandemic-related revenue losses. About one-sixth of the funding ($5 billion) is reserved for restaurants with gross receipts of $500,000 or less in 2019.

Shuttered Venue Operators Grant Program ($16 Billion, Net Cost)

Businesses including live venue operators and theatrical producers may qualify for grants of up to 45 percent of their gross earned revenue, with a maximum grant amount of $10 million. No less than $2 billion is reserved for smaller venues with up to 50 employees.

Tax Measures ($252 Billion, Net Cost)

The CARES Act included temporary provisions to boost cash flow for certain business through the tax code, though those measures are not exclusively focused on small businesses. Some of those provisions have been amended and extended.

Employee Retention Credit

In 2020, certain employers were eligible for a partially refundable payroll tax credit of up to $5,000 per employee per calendar quarter on wages paid after March 12, 2020 and before January 1, 2021. From January 1—December 31, employers are eligible for a credit of up to $7,000 per employee per calendar quarter. The net cost of the employee retention credits is estimated to be $46 billion, according to projections by the Committee for a Responsible Federal Budget (CRFB) and the Congressional Budget Office.

Operating Losses and Business Interest

As part of the Tax Cuts and Jobs Act, businesses with net operating losses are able to deduct losses of up to 80 percent of their operating income. Any losses in excess of that amount could be carried forward to reduce taxable income in future years. The CARES Act increased that allowance to 100 percent of taxable income and permits businesses to carry those losses backward as well as forward. In effect, some businesses will be eligible for tax refunds for previous years. In addition, any excess losses can be applied to the non-business income (for example, wages and investment earnings) of business owners. Finally, the act temporarily increased the amount of interest expenses that businesses may deduct. CRFB estimates that the net cost of those modifications will be $206 billion.

State and Local Support

In addition to measures enacted by the federal government, many state and local governments have authorized or are considering measures to protect small businesses. Such measures include cash infusions through loans, grants, and economic development funds, as well as cost deferrals on taxes, rent, and utilities.

Small Business Debt Relief Program ($17 Billion, Net Cost)

This program was intended to provide relief to small businesses for payment of debt on existing non-disaster-related SBA loans, including loans specifically designed for small businesses, economic development loans, and microloans. No application was required — as part of that effort, the SBA automatically paid six months of principal, interest, and associated fees on loans in regular servicing status as well as for new loans approved prior to September 27, 2020.

Federal Reserve Lending ($600 billion, total available for loans)

The Federal Reserve created the Main Street Lending Program to support small- and medium-sized businesses. The program was intended to support up to $600 billion in loans via eligible lenders and was run by an entity created by the Federal Reserve Bank of Boston. For various reasons — including the novelty of such a program for the central bank — the program was considered by some policymakers to be underperforming, and it ceased operations in early January without having a significant impact on the recovery.

Image credit: Photo by Justin Sullivan/Getty Images

Further Reading

Should We Eliminate the Social Security Tax Cap?

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

No Taxes on Tips Will Drive Deficits Higher

Here’s how this new, temporary deduction will affect federal revenues, budget deficits, and tax equity.

Three Reasons Why Assuming Sustained 3% Growth is a Budget Gimmick

GDP growth of 3 percent is significantly higher than independent, nonpartisan estimates and historically difficult to achieve.