You are here

“Build Back Better” is Mostly Paid For — But Uses Budget Gimmicks

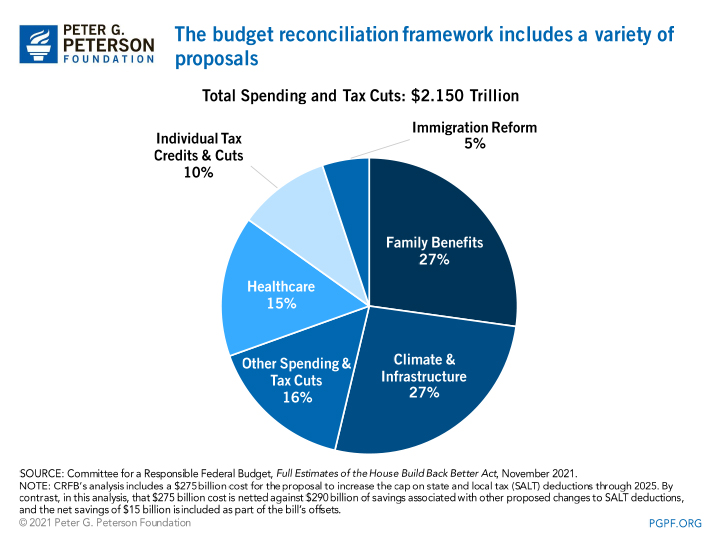

After months of negotiations, the House of Representatives has passed a major budget reconciliation bill that aims to accomplish numerous priorities of the Biden Administration. The Build Back Better Act, which is now in the hands of the Senate, proposes $2.2 trillion in new spending and tax cuts and would offset nearly $2 trillion of that total, based on estimates from the Congressional Budget Office and calculations by the Committee for a Responsible Federal Budget (CRFB).1

The Build Back Better Act includes spending on a wide variety of policy areas. If enacted, the legislation would provide benefits for many lower-income households, take steps to address climate change, and make other social investments.

CRFB’s analysis indicates that the legislation is mostly paid for on paper; however, the package relies on budget timing gimmicks that could potentially hide the true cost of the proposed programs and create year-to-year uncertainty for millions of Americans affected by the legislation. Several of the proposed programs in the package would expire within the 10-year budget window. For example, the extensions of the increased Child Tax Credit and the expanded Earned Income Tax Credit both expire after just one year. If lawmakers choose to extend them again in the future, the true cost of the package could be much higher over the next 10 years (unless future extensions are also offset).

| Policy Area | Includes Programs Like ... | Cost |

|---|---|---|

| Family Benefits | Universal pre-k; an affordable child care program; paid family and medical leave | $585 billion |

| Climate & Infrastructure | Investments in clean energy and climate resilience; clean energy and electric tax credits; clean fuel and vehicle tax credits | $570 billion |

| Healthcare | Strengthen Medicaid home- and community-based services; Extend expanded Affordable Care Act premium tax credits; Medicare hearing benefit | $330 billion |

| Individual Tax Credits & Cuts | Extend increase in Child Tax Credit for one year; Extend expanded Earned Income Tax Credit for one year | $215 billion |

| Immigration Reform | Deportation protection and work permits for undocumented immigrants; allow individuals to pay to access green cards faster; make unused visas from past years available | $110 billion |

| Other Spending & Tax Cuts | Build and support affordable housing; increase higher education and workforce spending | $340 billion |

SOURCE: Committee for a Responsible Federal Budget, What’s in the House’s Build Back Better Act?, November 2021.

NOTE: Proposed immigration spending is dependent on Byrd Rule compliance.

© 2021 Peter G. Peterson Foundation

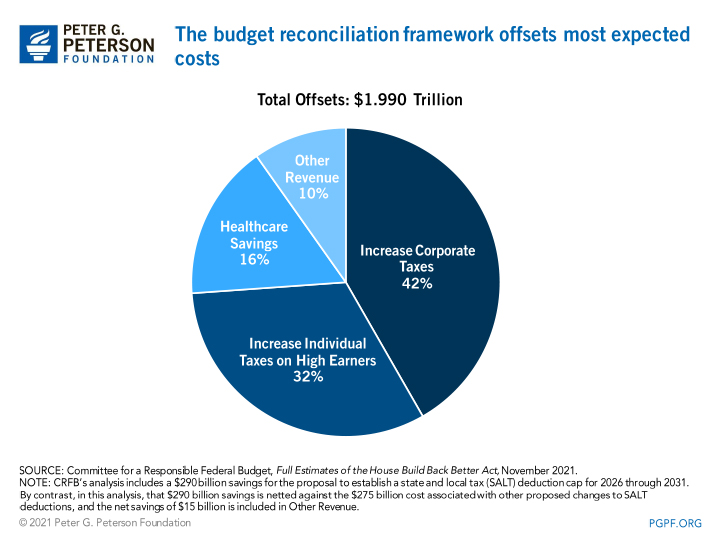

CRFB calculates that the package would be mostly paid for with offsets that are primarily focused on tax increases for the wealthy and large corporations.

| Offset | Includes Changes Like ... | Savings |

|---|---|---|

| Increase Corporate Taxes | 15 percent domestic minimum tax on large corporations; 15 percent global minimum tax; 1 percent surcharge on corporate stock buybacks | $830 billion |

| Increase Individual Taxes on High Earners | Expand the 3.8 percent net investment income tax; 5 percent surtax on income above $10 million; 8 percent surtax on income above $25 million | $640 billion |

| Healthcare Savings | Repeal Trump Administration drug rebate rule; prescription drug reforms | $325 billion |

| Other Revenue | Reduce the tax gap by funding IRS and other measures; reinstate superfund taxes on oil; expand nicotine taxes; reform tax treatment of retirement accounts | $195 billion |

SOURCE: Committee for a Responsible Federal Budget, What’s in the House’s Build Back Better Act?, November 2021.

© 2021 Peter G. Peterson Foundation

While it is commendable that the bill includes proposed offsets for most of its spending, lawmakers still have an important opportunity to further improve this legislation by fully paying for their priorities in a durable and sustainable way, avoiding budget gimmicks, and providing more certainty for the economy, budget, and society.

1 CRFB separates the costs and savings that would result from proposed changes to the state and local tax deduction (SALT). By contrast, this analysis groups all proposed SALT changes together as a $15 billion offset in Other Revenue. (Back to Citation).

Related: What is in the Build Back Better Act?

Image Credit: Getty Images