You are here

Federal Deficit and Debt: November 2022

Every month the U.S. Treasury releases data on the federal budget, including the current deficit. The following contains budget data for November 2022, which was the second month of fiscal year (FY) 2023.

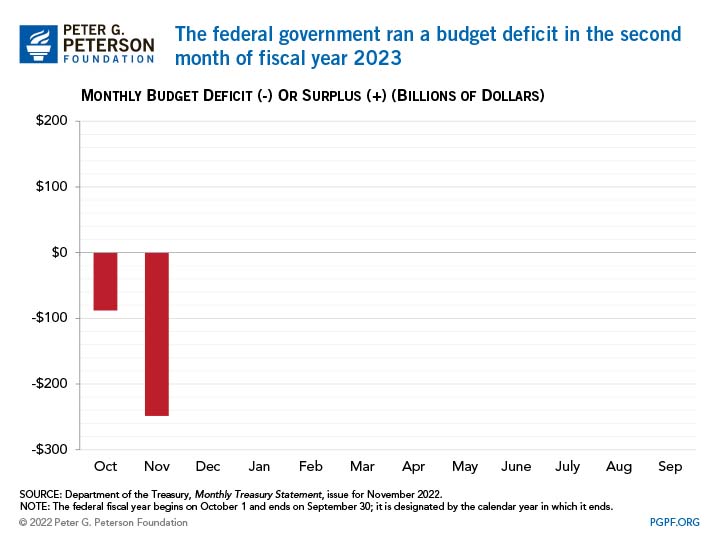

Current Federal Deficit

- Federal Budget Deficit for November 2022: $248 billion

- Federal Budget Deficit for November 2021: $191 billion

The federal government ran a deficit of $248 billion in November 2022, $57 billion higher than the deficit of $191 billion that was recorded in November 2021. That increase is due to higher outlays and lower revenues this month than in November 2021. Spending was up primarily due to a $17 billion increase in net interest, largely because interest rates have risen. The decrease in revenues was driven by a $24 billion fall in payroll and income taxes collected as well as an $8 billion drop in remittances from the Federal Reserve.

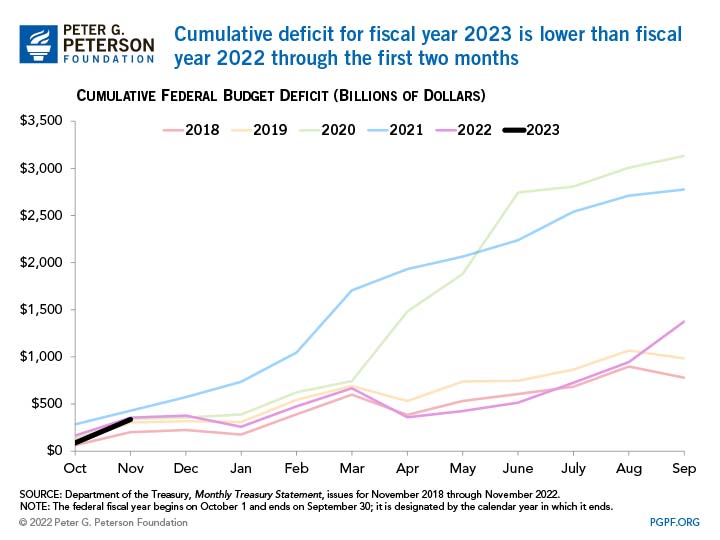

Cumulative Federal Deficit

- Cumulative FY23 Deficit: $336 billion

- Cumulative FY22 Deficit: $356 billion

The cumulative deficit so far this year is $20 billion below last year’s level. However, because October 1 fell on a weekend in 2022, certain federal payments were shifted into September, leading to decreased outlays for this fiscal year. Without such shifts, the cumulative deficit for FY23 to date would have been $43 billion greater than the same two months of FY22.

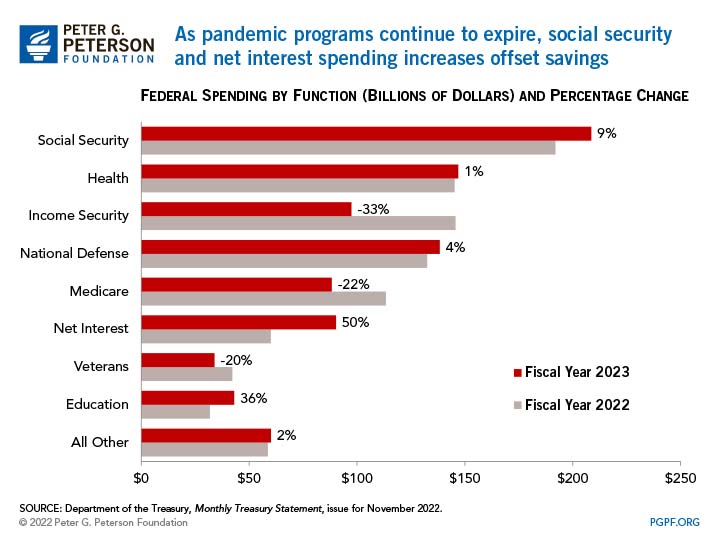

For the first two months of FY23, total outlays were $907 billion, around $15 billion less than the same period in the previous year. The shift in timing of payments reduced outlays by $47 billion relative to FY22; a large portion of that shift was related to Medicare payments. Spending for the refundable portion of the child tax credit also led to a decrease in outlays of $33 billion. Offsetting those reductions in outlays were increased interest payments of $30 billion as well as higher spending on programs such as Social Security, Medicare, and defense.

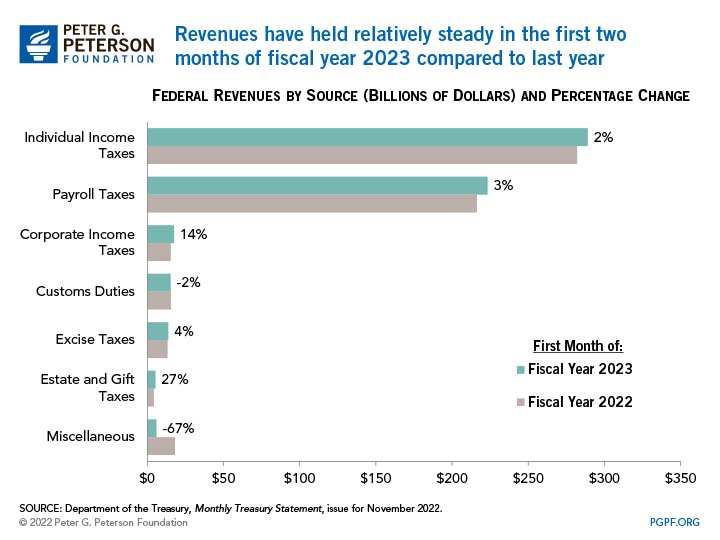

Higher collections of individual income and payroll taxes this year have been mostly offset by lower collections unemployment insurance and miscellaneous receipts. As a result, total revenues have increased by $5 billion in the first two months of FY23 compared to the previous year.

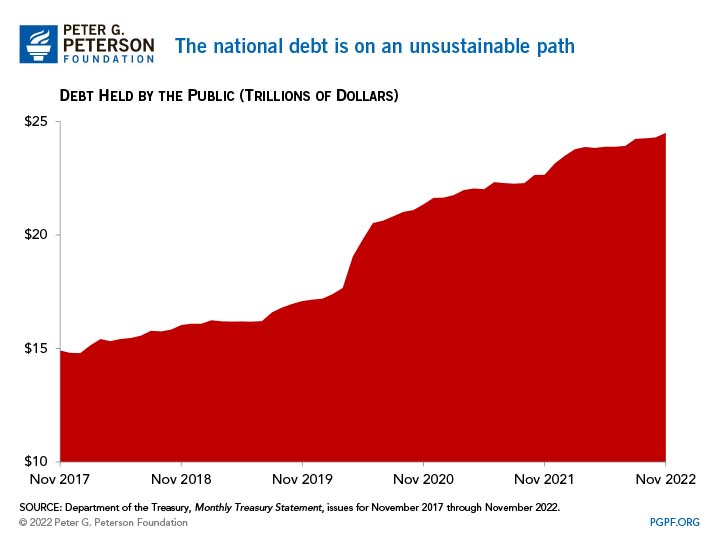

National Debt

- Debt Held by the Public at the end of November 2022: $24.3 trillion

- Debt Held by the Public at the end of November 2021: $22.6 trillion

Since the financial crisis in 2008, debt held by the public has nearly tripled relative to the size of the economy and is projected to grow even more in the future. Debt and deficits are on an unsustainable upward trajectory. With the arrival of a new Congress in January, legislators should work with the Biden Administration to create bipartisan solutions to improve the country’s fiscal outlook.