You are here

Federal Deficit and Debt: May 2023

Every month the U.S. Treasury releases data on the federal budget, including the current deficit. The following contains budget data for May 2023, which was the eighth month of fiscal year (FY) 2023.

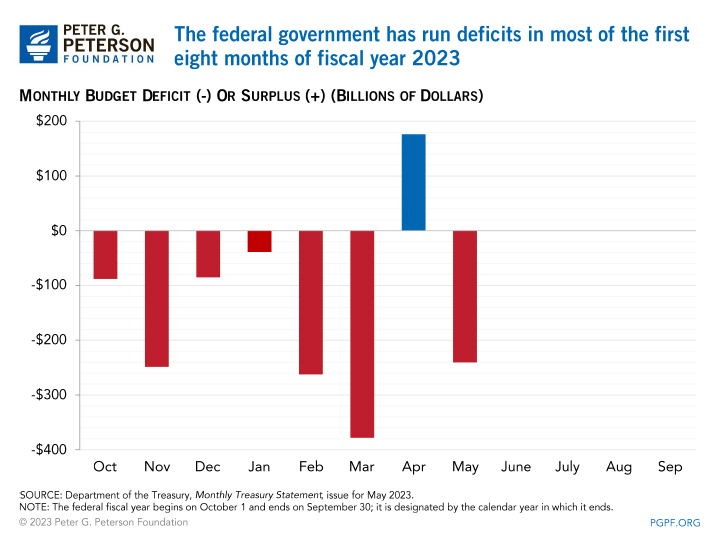

Current Federal Deficit

- Federal Budget Deficit for May 2023: $240 billion

- Federal Budget Deficit for May 2022: $66 billion

The federal government ran a deficit of $240 billion in May 2023, a $174 billion increase from the deficit of $66 billion that was recorded in May 2022. However, because May 1, 2022 fell on a weekend, certain payments that would have occurred then were shifted into April, thereby decreasing outlays last year. Excluding the effect of that shift, the deficit would have been $131 billion in May 2022 and the difference from last year would have been $109 billion.

Spending was up by $93 billion relative to last year and revenues fell by $82 billion. The largest increase in spending occurred for Medicare ($57 billion). Other categories that saw spending grow by more than $10 billion compared with May 2022 were the Federal Deposit Insurance Corporation, Social Security, and veterans’ benefits and services. On the revenue side, the largest sources of decline were remittances from the Federal Reserve (down by $12 billion) and refunds of individual income taxes, which increased by $9 billion.

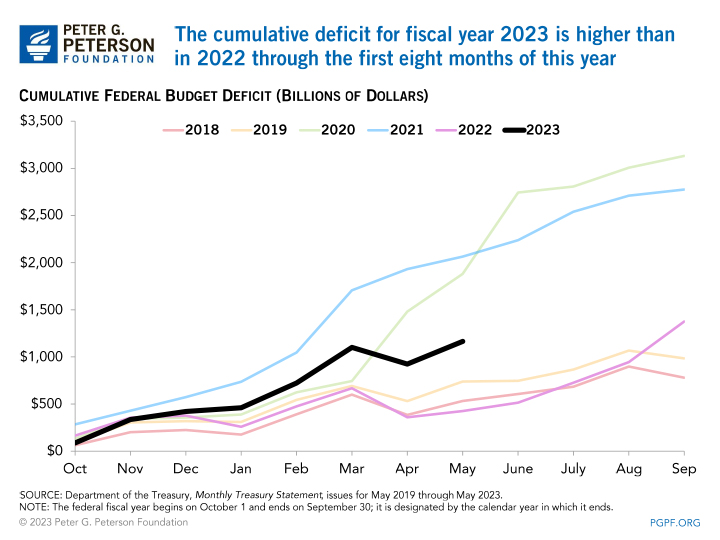

Cumulative Federal Deficit

- Cumulative FY23 Deficit: $1.2 trillion

- Cumulative FY22 Deficit: $426 billion

The cumulative deficit so far this year is $739 billion above last year’s level. However, because October 1 fell on a weekend in 2022, certain federal payments were shifted into September (the previous fiscal year), leading to a $63 billion decrease in outlays for this fiscal year. Without those effects, the deficit for FY23 to date would be $802 billion above last year’s corresponding total.

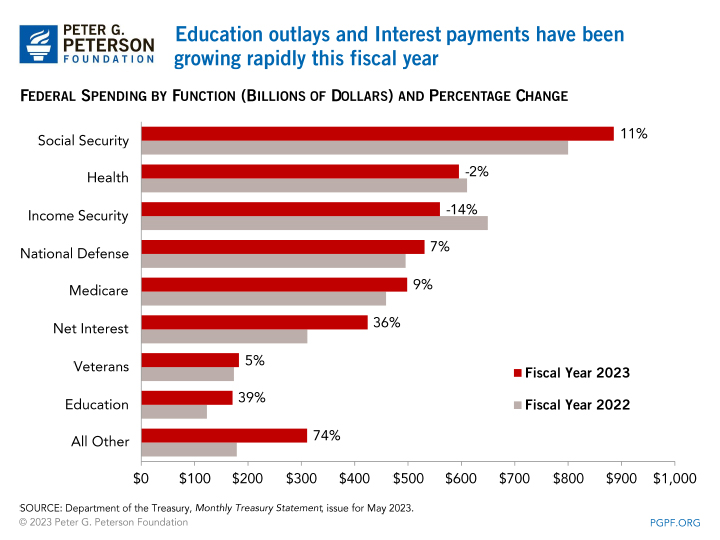

For the first eight months of FY23, total outlays were $4.2 trillion, $358 billion higher than the same period in the previous year (not accounting for timing shifts). The largest categories of growth in outlays were interest payments ($113 billion larger in 2023), higher spending for Social Security ($86 billion), and a reduction in receipts from the auction of licenses to use the electromagnetic spectrum (which are recorded as offsets to spending and are down by $81 billion). Partially offsetting those increases were the expiration of advance payments for the child tax credit (which were recorded as outlays) and a decline in spending by the Public Health and Social Services Emergency Fund.

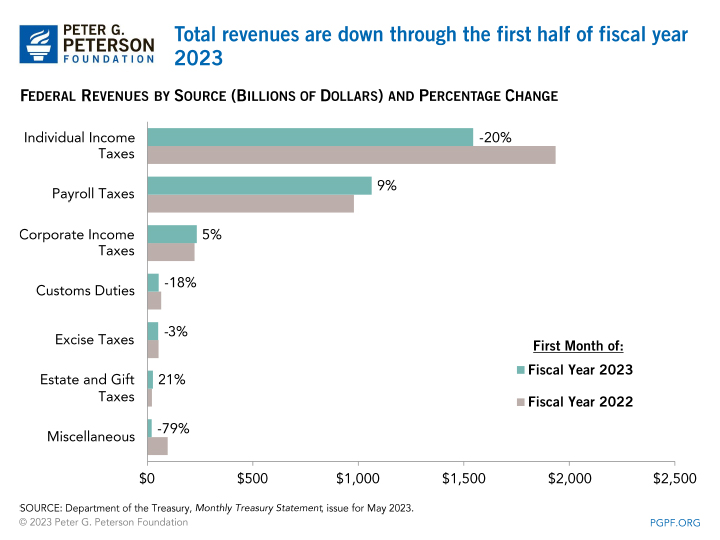

Through the first eight months of FY23, total revenues have decreased by $380 billion compared to the previous year. The largest decreases were in individual income taxes, which fell by $390 billion, and remittances from the Federal Reserve, which were down by $82 billion. Partially offsetting those effects were an $84 billion increase in payroll taxes and an $11 billion increase in corporate income taxes.

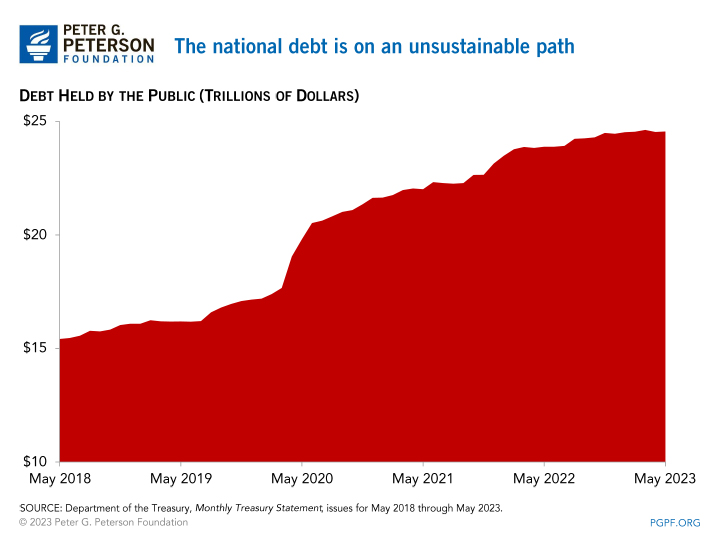

National Debt

- Debt Held by the Public at the end of May 2023: $24.6 trillion

- Debt Held by the Public at the end of May 2022: $23.9 trillion

Since the financial crisis in 2008, debt held by the public has nearly tripled relative to the size of the economy and is projected to grow even more in the future. Debt and deficits are on an unsustainable upward trajectory. With the new Congress officially in session, legislators are encouraged to work with the Biden Administration to create bipartisan solutions to improve the country’s fiscal outlook.