You are here

Federal Deficit and Debt: September 2023

Every month the U.S. Treasury releases data on the federal budget, including the current deficit. The following contains budget data for September 2023, the final month of fiscal year (FY) 2023.

Current Federal Deficit

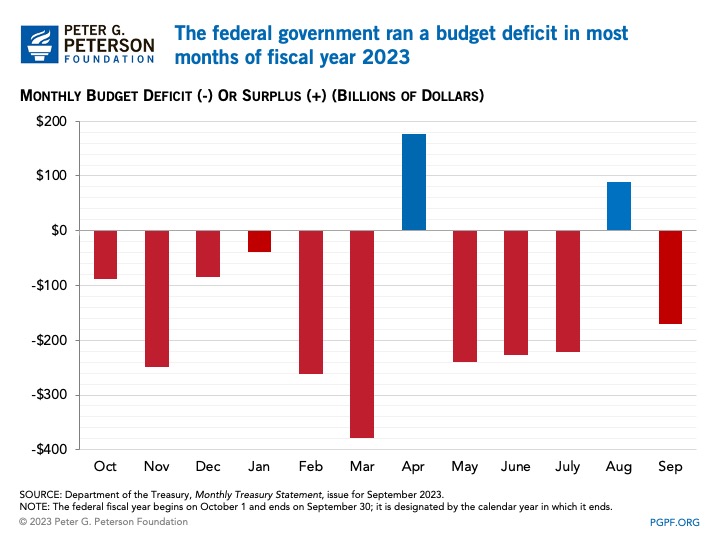

- Federal Budget Deficit for September 2023: $171 billion

- Federal Budget Deficit for September 2022: $430 billion

The federal government ran a deficit of $171 billion in September 2023 — $259 billion less than the deficit of $430 billion that was recorded in September 2022. However, October 1 fell on a weekend in FY22 and FY23, causing certain payments to shift into September, increasing outlays for the month ($63 billion in FY22 and $72 billion in FY23). Excluding the effects of the timing shifts, the deficit would have been $99 billion in September 2023, and the year-over-year difference would have been a $268 billion decrease.

Spending in September 2023 was down $279 billion compared to the same month in 2022, not adjusting for the timing shift. The significant decrease in spending stems from a $379 billion adjustment recorded by the Department of Education in September 2022, reflecting the costs of cancellation for the loans of many borrowers. Much of that cost was offset in August 2023, when outlays were reduced by $333 billion in light of the Supreme Court decision regarding debt forgiveness. Without the adjustment recorded in September 2022, outlays in September 2023 were $100 billion higher than the year before. Revenues in September 2023 were $20 billion below collections from a year ago, mostly from slightly lower individual income and corporate taxes, as well as a decrease in estate and gift taxes and customs duties.

Cumulative Federal Deficit

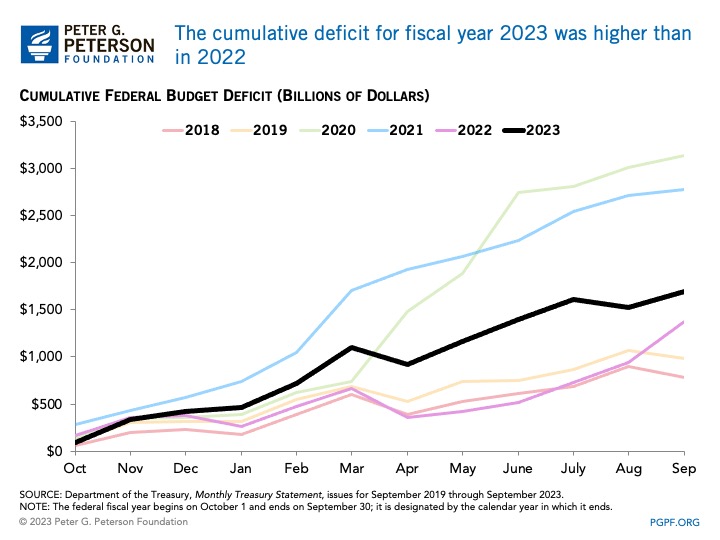

- Cumulative FY23 Deficit: $1.7 trillion

- Cumulative FY22 Deficit: $1.4 trillion

The deficit in FY23 was $320 billion above the previous year’s level. Without the timing effects, the deficit for FY23 would be $374 billion above the corresponding total for the year before. However, the budgetary treatment of the Administration’s planned cancellation of some student loans — which was never implemented because of the Supreme Court’s decision prohibiting it — masks a much larger underlying difference in outlays and distorts each year’s deficit. Excluding the offsetting effects associated with student debt forgiveness, the actual deficit in FY23 was $2 trillion, more than double the underlying deficit in FY22.

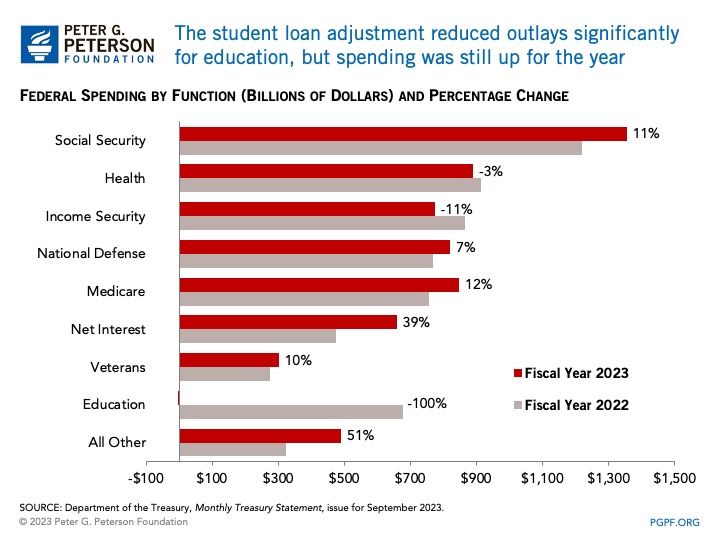

In FY23, total outlays were $6.1 trillion, $137 billion less than the same period in the previous year (without adjusting for timing shifts). However, if not for the effects of the student loan adjustments in 2022 and 2023, outlays would have been $6.5 trillion in FY23, a $575 billion increase compared to the previous year. More than one-quarter of that increase stemmed from growth in interest costs, which rose by $184 billion, or 39 percent, mostly due to higher interest rates. Other categories that have grown significantly are higher spending for Social Security ($136 billion), a reduction in receipts from the auction of licenses to use the electromagnetic spectrum (which are recorded as offsets to spending and are down by $104 billion), and an increase in deposit insurance ($101 billion). Partially offsetting those increases were the expiration of advance payments for the child tax credit (which were recorded as outlays) and spending on pandemic relief programs for state, local, tribal, and territorial governments and public health.

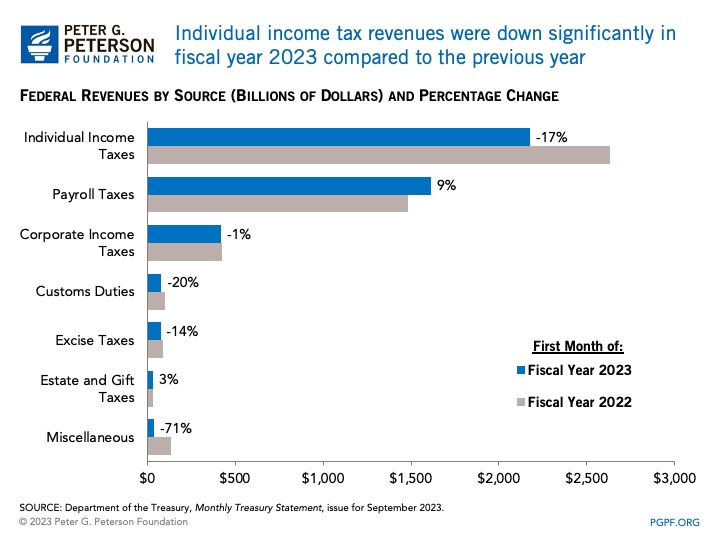

In FY23, total revenues decreased by $457 billion compared to the previous year. The largest decreases were in individual income taxes, which fell by $456 billion, and remittances from the Federal Reserve, which were down by $107 billion. Partially offsetting those effects was a $131 billion increase in payroll taxes.

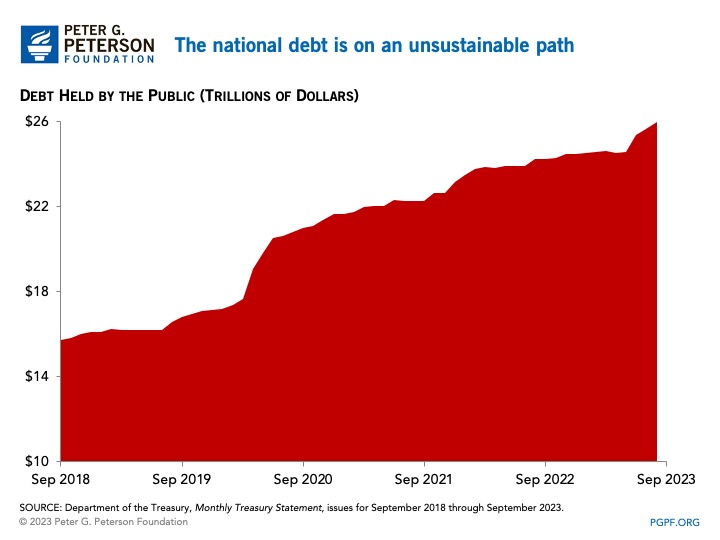

National Debt

- Debt Held by the Public at the end of September 2023: $26.2 trillion

- Debt Held by the Public at the end of September 2022: $24.3 trillion

If not for the adjustments related to student loan forgiveness, the nation would have posted a deficit in FY23 exceeding $2 trillion. That historic imbalance of spending and revenues occurred despite a strong year of economic activity, and deficits are projected to grow even more over the next decade. The unsustainable upward trajectory of deficits and debt argues for bipartisan solutions to improve the country’s fiscal outlook, including a fiscal commission.