You are here

Federal Deficit and Debt: July 2022

Every month the U.S. Treasury releases data on the federal budget, including the current deficit. The following contains budget data for July 2022, which was the tenth month of fiscal year (FY) 2022.

Current Federal Deficit

- Federal Budget Deficit for July 2022: $211 billion

- Federal Budget Deficit for July 2021: $302 billion

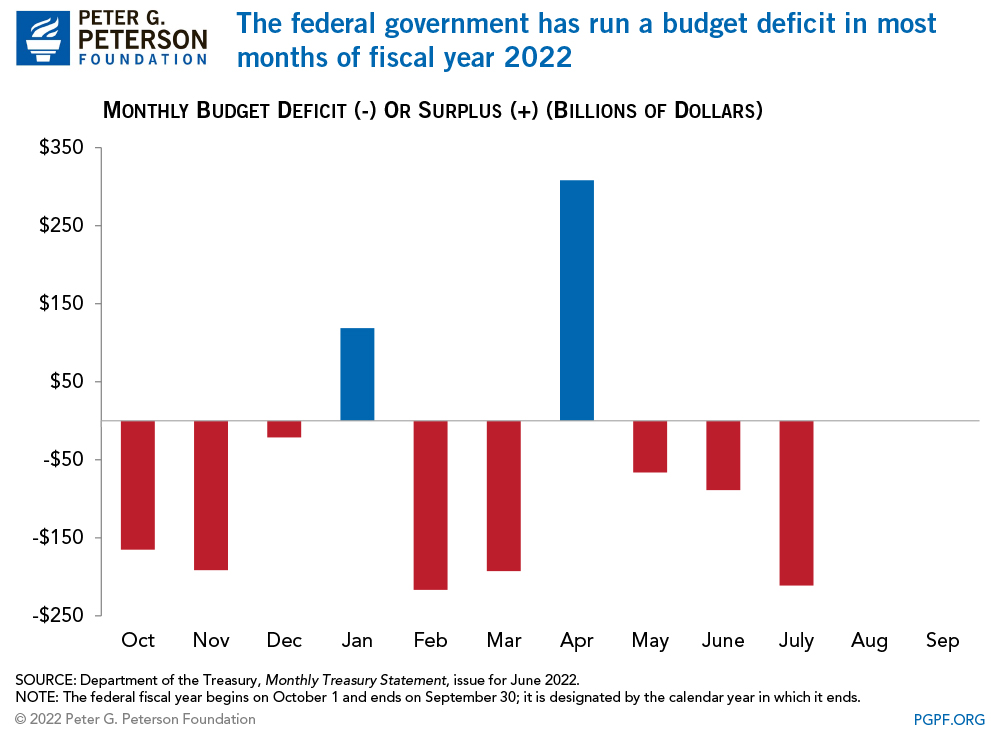

The federal government ran a deficit of $211 billion in July 2022, an improvement of $91 billion from the deficit of $302 billion that was recorded in July 2021. That improvement was reflected in outlays that were $84 billion lower in July 2022 than they were in the same month last year, and revenues that were $7 billion higher.

Because August 1 fell on a weekend in 2021, certain federal payments were shifted forward into July, leading to decreased outlays for that month. Without such shifts, the deficit for July 2022 would have been just $31 billion smaller than the deficit for July 2021 – or an improvement of $60 billion.

Cumulative Federal Deficit

- Cumulative FY22 Deficit Through July 2022: $726 billion

- Cumulative Budget Deficit Over Same Period in FY21: $2,540 billion

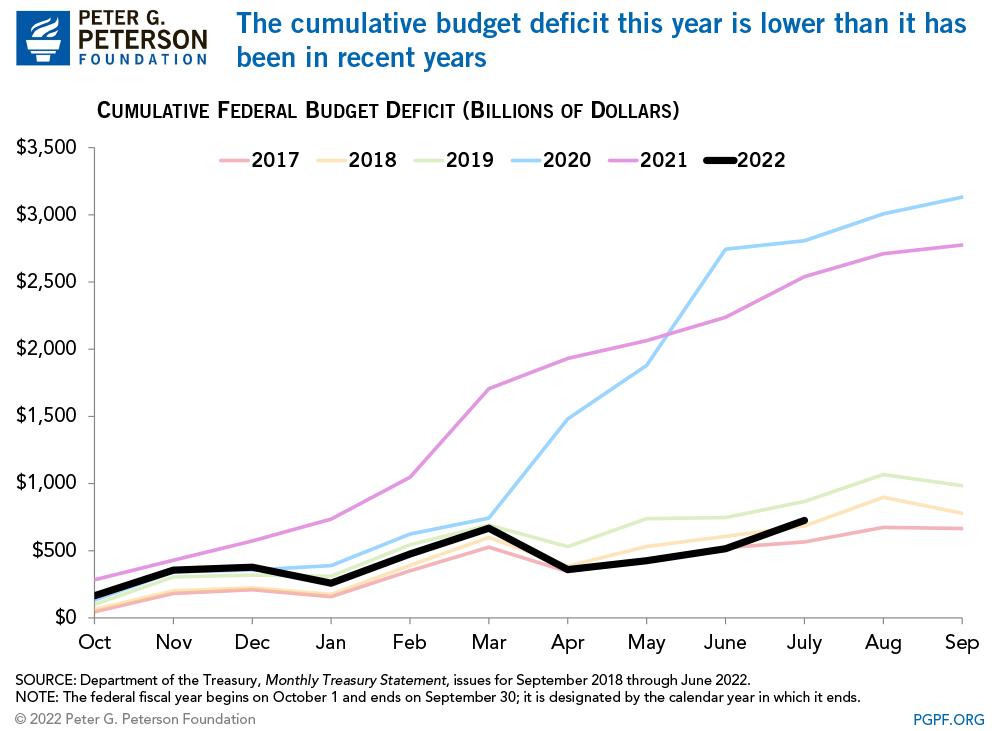

The cumulative deficit for the first ten months of FY22 was $1,814 billion (or around 70 percent) lower than it was through the first ten months of FY21, reflecting a $1,027 billion decrease in outlays and a $787 billion increase in revenues.

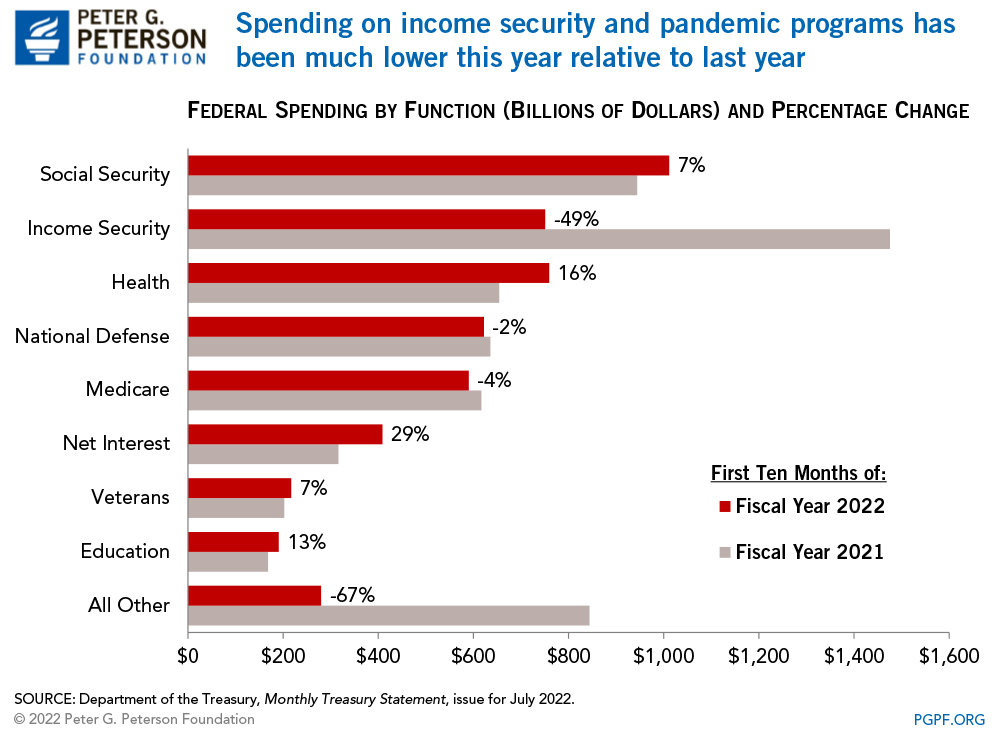

The large decrease in outlays results from the waning federal response to the COVID-19 pandemic. The lack of recovery rebates in the first ten months of FY22, compared to two separate rounds of such payments during the first ten months of FY21, accounts for 44 percent of the decline in outlays between the two years. Lower spending on unemployment compensation and programs administered by the Small Business Administration also account for a significant share of the difference. CBO’s most recent estimate for outlays in FY22 was $5.9 trillion, which would be a year-over-year decrease of 14 percent.

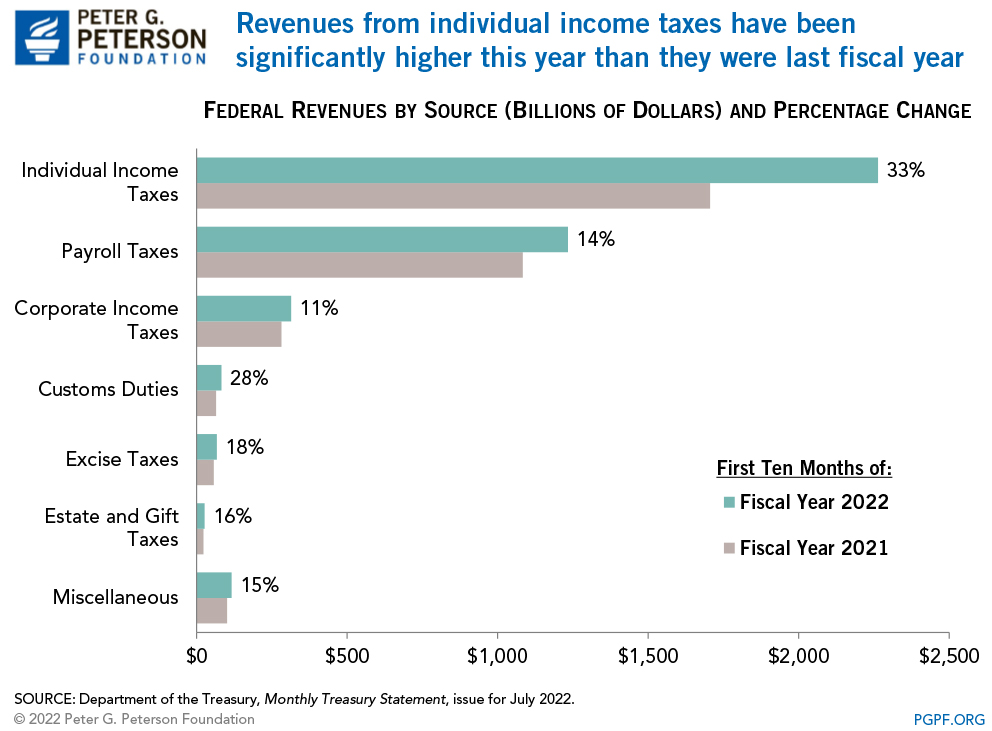

Higher collections of individual income and payroll taxes accounted for 90 percent of the increase in revenues during the first ten months of FY22. That development is due to higher wages and salaries that have led to increased tax withholdings, especially among workers with relatively high incomes. In addition, pandemic-related legislation allowed for deferrals of certain payroll tax payments into the early months of FY22. In May, CBO estimated that total revenue collections in FY22 would total $4.8 trillion — a year-over-year increase of 19 percent.

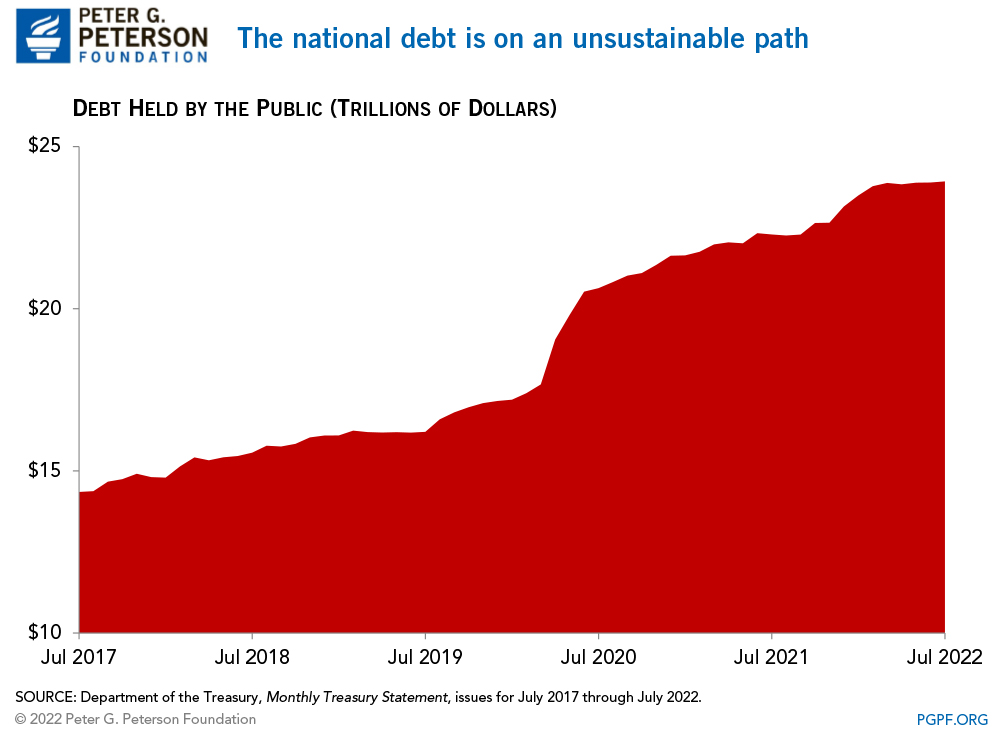

National Debt

- Debt Held by the Public at the end of July 2022: $23.9 trillion

- Debt Held by the Public at the end of July 2021: $22.3 trillion

Since the onset of the COVID-19 pandemic, debt held by the public has increased by 35 percent, and is projected to grow significantly in the future. Now that the worst of the COVID-19 pandemic is behind us, it is time to chart a comprehensive path to a sustainable fiscal future.