You are here

Federal Deficit and Debt: February 2024

Every month the U.S. Treasury releases data on the federal budget, including the current deficit. The following contains budget data for February 2024, the fifth month of fiscal year (FY) 2024.

Current Federal Deficit

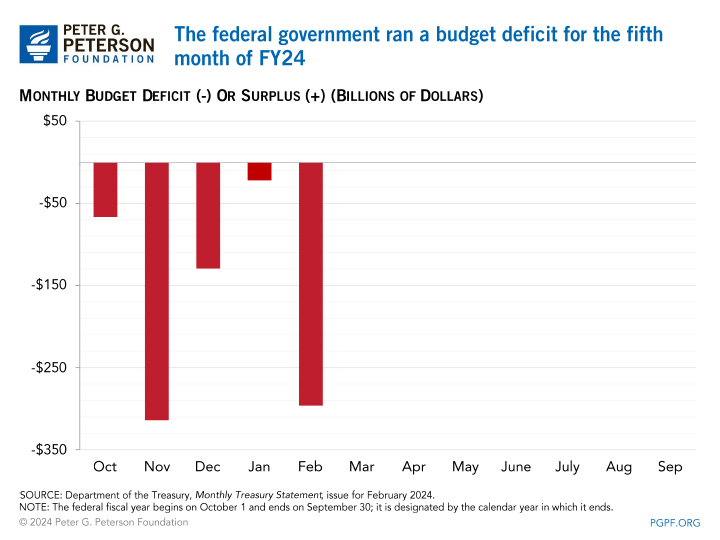

- Federal Budget Deficit for February 2024: $296 billion

- Federal Budget Deficit for February 2023: $262 billion

The federal government ran a deficit of $296 billion in February 2024 — $34 billion more than the deficit of $262 billion that was recorded in February 2023. Spending in February 2024 was up by $43 billion compared to last year, primarily driven by an increase in outlays for net interest ($26 billion more than in February 2023). Other relatively large increases occurred for Social Security ($7 billion), National Defense ($5 billion), and Medicare ($5 billion). Revenues in February 2024 were $9 billion above collections from a year ago, mainly due to increased collections of withheld income taxes ($16 billion more than in February 2023) and payroll taxes ($6 billion). Partially offsetting those increased collections were lower collections of estate and gift taxes ($8 billion less than in February 2023) and a $6 billion increase in individual tax refunds, which reduced receipts.

Cumulative Federal Deficit

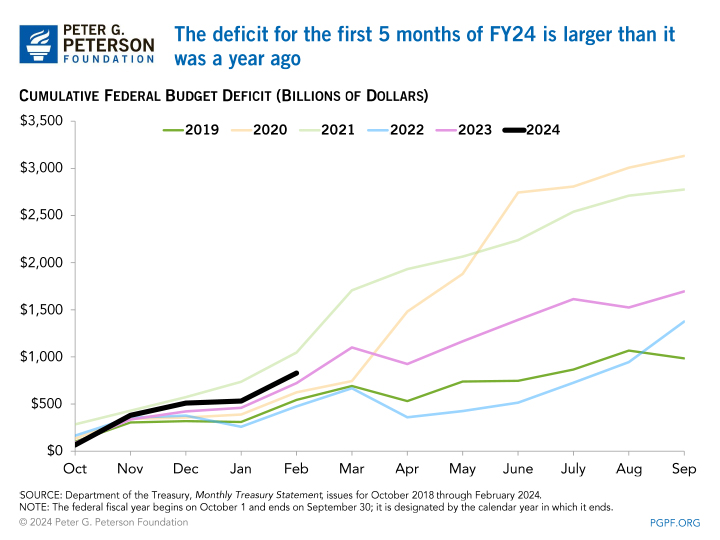

- Cumulative FY24 Deficit: $828 billion

- Cumulative FY23 Deficit: $723 billion

This year’s cumulative deficit is $106 billion above last year’s level. However, because October 1 fell on a weekend in 2022 and 2023, certain federal payments were shifted into the previous fiscal year in both FY23 and FY24. Without those effects the deficit for FY24 through the end of February would be $115 billion above last year’s corresponding total.

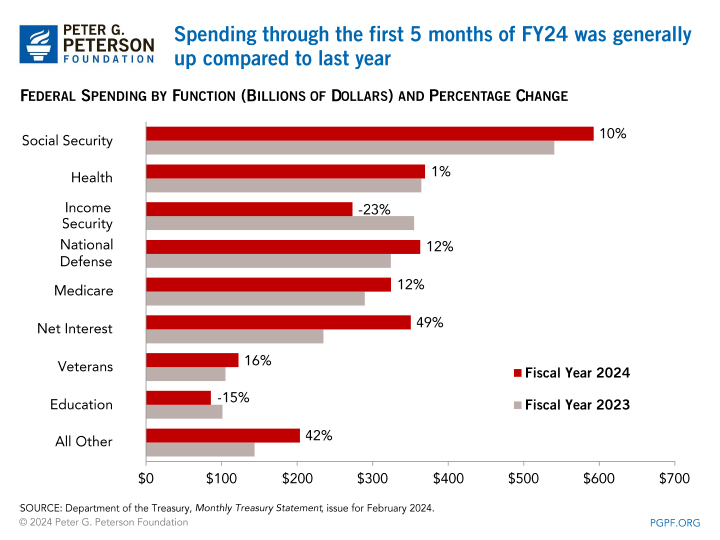

For the first five months of FY24, total outlays were $2.7 trillion, $227 billion higher than the same period in the previous year. Adjusting for timing shifts, spending was $236 billion above the same period last year. Two areas of the budget have experienced rapid increases so far this year. Net interest has grown by $116 billion (49 percent) relative to the first five months of last fiscal year, mostly due to higher interest rates; deposit insurance has risen by $61 billion because of actions related to bank failures in 2023. In addition, spending on Social Security, Medicare, and defense increased significantly in the first five months of the fiscal year. Partially offsetting those increases in outlays was a $39 billion decrease in spending by the Pension Benefit Guaranty Corporation (PBGC) because certain one-time payments were made to pension plans in FY23 but not FY24. Other categories of outlays that decreased were related to the government’s response to the COVID-19 pandemic ($21 billion), spending associated with the end of emergency funding for the Supplemental Nutrition Assistance Program ($21 billion), and the total for the Department of Education ($15 billion) because some transactions related to the student loan program were recorded in FY23 (but not in FY24).

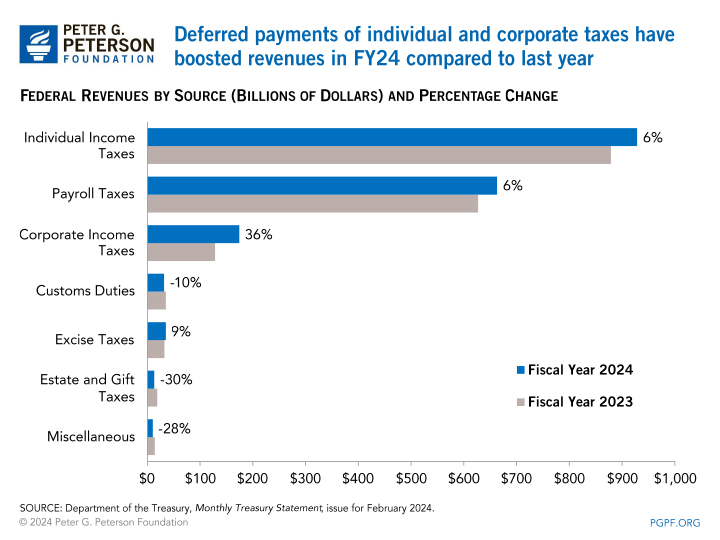

Through the first five months of FY24, total revenues increased by $121 billion compared to the previous year. Collections of individual and corporate income taxes have been much higher in FY24 than through the same period in FY23, driven by deferred payments of individual and corporate income taxes for taxpayers in locations that suffered natural disasters.

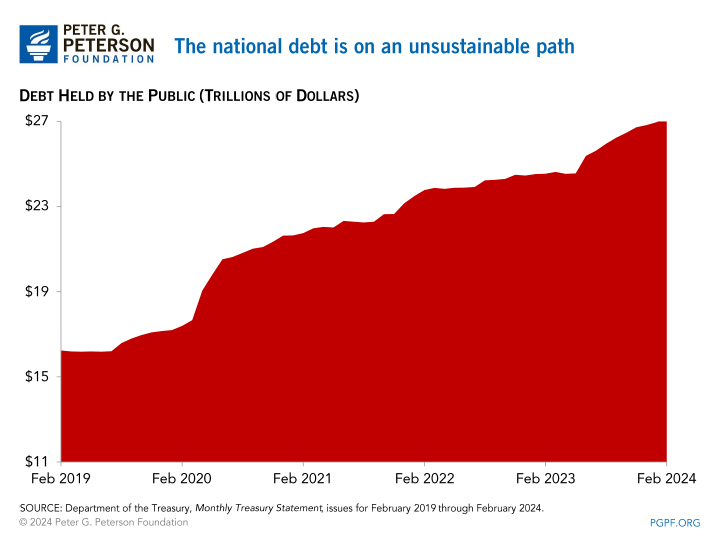

National Debt

- Debt Held by the Public at the end of February 2024: $27.3 trillion

- Debt Held by the Public at the end of February 2023: $24.5 trillion

Despite a healthy economy, spending has been rapidly outpacing revenue collection. The unsustainable upward trajectory of deficits and debt argues for bipartisan solutions to improve the country’s fiscal outlook; a fiscal commission could help Congress consider options to put the country on a better path.